Data Engineering and Data Transformation Services witnesses steep growth trajectory

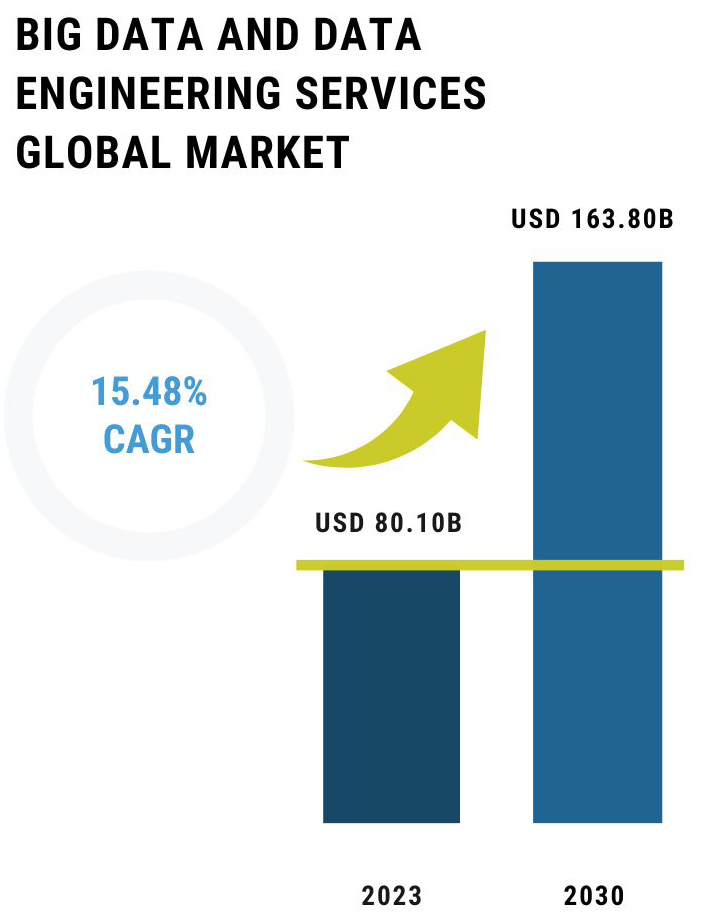

The Big Data and Data Engineering Services Market is set for significant expansion. As companies navigate this complex landscape, choosing the right tools and platforms like Snowflake and Databricks will be crucial for leveraging data effectively and securing competitive advantages. The Big Data and Data Engineering Services Market has witnessed significant growth, valued at USD 80.10 billion in 2023 and projected to soar to USD 163.80 billion by 2030. This represents a robust compound annual growth rate (CAGR) of 15.48% from 2024 to 2030.

This expansion is driven by several key factors, including the exponential growth in data generation, the increasing shift towards cloud-based solutions, and advancements in artificial intelligence (AI) and data analytics. Additionally, the demand for real-time data processing and the proliferation of Internet of Things (IoT) devices contribute to the rising need for sophisticated data engineering services.

Latest Trends in Data Engineering

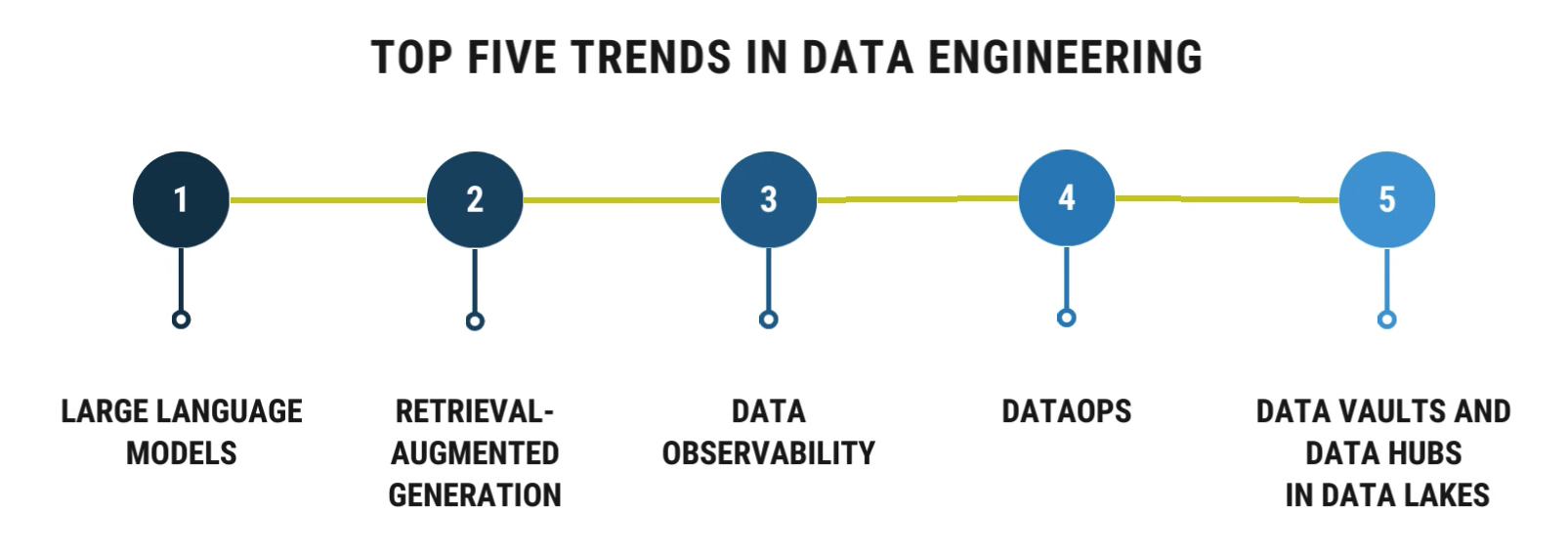

The landscape of data engineering is rapidly evolving with several trends marking their prominence in 2024:

- Large Language Models (LLMs): LLMs are transforming data stacks by automating tasks such as integration, cleansing, and pipeline generation. This automation enhances productivity and optimizes data handling, paving the way for new roles within the data science domain.

- Retrieval-Augmented Generation (RAG): RAG techniques improve the accuracy of generative AI models by incorporating real-time data from external sources. This approach enhances the reliability of the models and reduces ambiguities in the data they process.

- Data Observability: With AI models becoming integral to business operations, maintaining high data quality through observability is essential. This proactive strategy helps detect and fix data issues before they affect the performance of the models.

- DataOps: By adopting DevOps principles in data management, DataOps promotes a collaborative environment that facilitates quick and reliable deployment of data pipelines, enhancing operational efficiency.

- Data Vaults and Data Hubs in Data Lakes: Data vaults provide a robust architecture for managing large and varied datasets within data lakes, ensuring scalability and data integrity. Meanwhile, data hubs centralize data management, facilitating efficient data exchange and improving data governance across organizations.

Both Snowflake and Databricks are pivotal players in the data engineering space, each with its unique strengths. Snowflake's design is particularly advantageous for organizations prioritizing fast and efficient SQL and ETL operations, while Databricks is ideally suited for complex data science applications. In terms of scalability, Databricks offers auto-scaling based on load, which contrasts with Snowflake's more static cluster resizing options.

In the evolving market of data engineering, both platforms are expanding their partner ecosystems and enhancing their offerings to meet the growing demands of enterprises worldwide. As they continue to innovate, the choice between Snowflake and Databricks often comes down to specific organizational needs and the strategic priorities of data engineering and science teams.

Snowflake and Databricks: Industry Innovators and Their Ecosystems

Snowflake

Snowflake has demonstrated a remarkable growth trajectory, with its customer base expanding to over 9,400 as of January 2024. This represents a year-on-year growth of over 25%. Known for its disruptive architecture, Snowflake excels in data storage, analysis, and sharing, holding a substantial market share of 18.33%. It stands out for its interactive query capabilities, thanks to optimized storage at the time of ingestion.

Partner Ecosystem: Snowflake's partner network has seen significant growth, now featuring 468 services partners globally. This network includes consulting and implementation partners who collectively employ over 5.6 million professionals. These partners are crucial in supporting Snowflake's continued expansion and enhancement of its Partner Network, particularly as the company aims for a growth target of $10 billion by 2030.

Databricks

Databricks, with a market share of 8.67%, focuses on providing comprehensive solutions for data science and machine learning workloads. It distinguishes itself with superior capabilities in continuous and batch ingestion with versioning. The platform is also noted for its robust integration features, such as hash integrations, which Snowflake lacks.

Partner Ecosystem: During Q2 2023, Databricks boasted approximately 455 service partners, with a significant concentration (72%) in North America and Europe. These partners range from small-scale boutique firms to larger entities, reflecting Databricks' strategic positioning across various markets. The partner program is geared towards accelerating the adoption of Databricks solutions globally.

Notable Acquisitions & Strategic Investment in the Data Engineering segment

In the fast-evolving sectors of data engineering and data cloud services, mergers and acquisitions (M&A) and strategic investments among partners of prominent platforms like Snowflake and Databricks are now seeing accelerated pace and significant investor interest. . This reflects a strategic shift where both mid-market and larger Consulting and IT Services firms are looking toward external acquisitions to enhance their Data Transformation and Engineering Capabilities and extend their market reach. The resulting synergies from these strategic investments not only boost the technological strength of the acquiring companies but also broaden their service offerings and client list, sharpening their competitive edge in a crucial high-growth market segment.. This trend highlights strong confidence in the growth potential and strategic value of these partnerships, setting the stage for innovative solutions and transforming the market landscape.

Mastek, a leader in digital engineering and cloud transformation, acquired BizAnalytica, a top-tier provider of data cloud and modernization solutions based in Boston, USA. This strategic move is set to enhance Mastek's global data services and generative AI capabilities by integrating BizAnalytica's extensive expertise in architectural design, system integration, data migration, and analytics. BizAnalytica, established in 2017, is renowned for its collaborations with major cloud platforms like Snowflake, Databricks, and AWS, which bolster its market presence. This acquisition not only strengthens Mastek's data cloud and analytics capabilities but also aligns with its vision to drive innovation and growth, making a significant impact on Mastek's trajectory in the competitive digital landscape.

Velir, a leading data-driven experience agency, has strategically acquired Brooklyn Data Co., a data and analytics consultancy noted for serving high-profile clients like 3Z Brands and the ACLU. This acquisition boosts Velir’s data capabilities, solidifying its role as a leader in crafting impactful digital experiences. Brooklyn Data Co. contributes a strong portfolio of modern data stack implementations using platforms like Snowflake and Sigma, complementing Velir's expertise in digital marketing, CRM, and customer data platforms. This merger enhances Velir’s ability to integrate advanced analytics into its digital experience and marketing strategies, driving transformative outcomes and increasing the capacity for organizations to utilize modern data tools and customer experience technologies effectively. This union is expected to deliver greater value to their clients and propel innovation within the digital experience sector.

NTT Data, a Tokyo-based IT services giant, has strategically acquired Aspirent, an Atlanta-based analytics and data advisory firm and a Snowflake Big Data partner. This acquisition enriches NTT Data’s service offerings by adding Aspirent’s expertise in analytics, information management, and cloud software development, while also enhancing its relationships with major cloud platforms including Azure, AWS, Databricks, and Snowflake. The merger adds over 230 data advisors and technologists to NTT Data, aligning with its strategy to expand its advisory capabilities and bolster its R&D, which involves a significant $3.6 billion annual investment. For Aspirent, this merger opens opportunities for growth, innovation, and the ability to deliver more comprehensive solutions to its clients, further positioning NTT Data as a trusted advisor in the digital transformation space.

CloudNation, a Dutch public cloud specialist and part of the Uniserver Group, has strategically acquired a majority stake in RevoData, a firm known for modernizing data platforms and a Databricks Partner. This acquisition significantly enhances CloudNation's capabilities, broadening its expertise to include advanced data management solutions across both private and public clouds. With RevoData’s strong foothold in the retail, manufacturing, and fintech sectors, and its use of technologies like Collibra and Fivetran, the deal positions CloudNation favorably to achieve its ambition of becoming the market leader in simplifying complex cloud issues for enterprise clients in the Netherlands. This move aligns with both the firms' growth strategies, which focuses on expanding through strategic acquisitions and strengthening its data management and artificial intelligence offerings.

Future Outlook

As the data engineering and transformation services sector evolves, we see the industry experiencing dynamic growth backed by the need for enterprises to make accelerated investments in their Data Transformation journey, while a large number of mid-market and large companies build new Data-driven approaches to business transformation. On the back of a large growing market opportunity, the Data Engineering segment continues to remain very attractive for both strategic investors and private equity investors. We are excited about the investment opportunities and future outlook for founder-led Data Transformation and Engineering specialists, where SA can enable flexible growth capital and Go-to-market revenue partnerships in the US or Western European markets to create significant value for shareholders. The primary drivers for investors, who have specific focus on the Data Engineering sector continue to be filling a key portfolio gap in the Data Transformation/ Engineering business, or acquiring advanced Data Engineering technology and software tools capabilities or expand data engineering & analytics capabilities to complement a large existing global Digital Transformation business in the US and European markets.

Several of our strategic and financial investors have allocated increased capital to invest-in or acquire Snowflake and Databricks partner capabilities and have active investment programs underway. We are excited about the range of options we can create for entrepreneurs and business owners in the Data Transformation and Engineering industry with our ability to structure flexible growth capital(equity or debt) or strategic investment/M&A solutions with participative growth models that drive long-term value.

To share feedback on this blog or explore a potential transaction opportunity you may be considering, please write to us at [email protected]

Newsletter Subscription

SubscribeREAD NEXT

- Smart, Connected, and Autonomous: The Role of Digital Engineering in Next-Gen Vehicle

- Opportunities in Generative AI: Fueling Innovation and Strategic Growth

- Digital Engineering: Powering Innovation & Growth Across Mission-Critical Industries

- Weaving the Future: How Data Fabric Powers Enterprise Transformation

- The Modernization Trinity: Unlocking Growth with Cloud, App and Data Modernization

Subscribe

Stay current with our latest insights in your inbox.