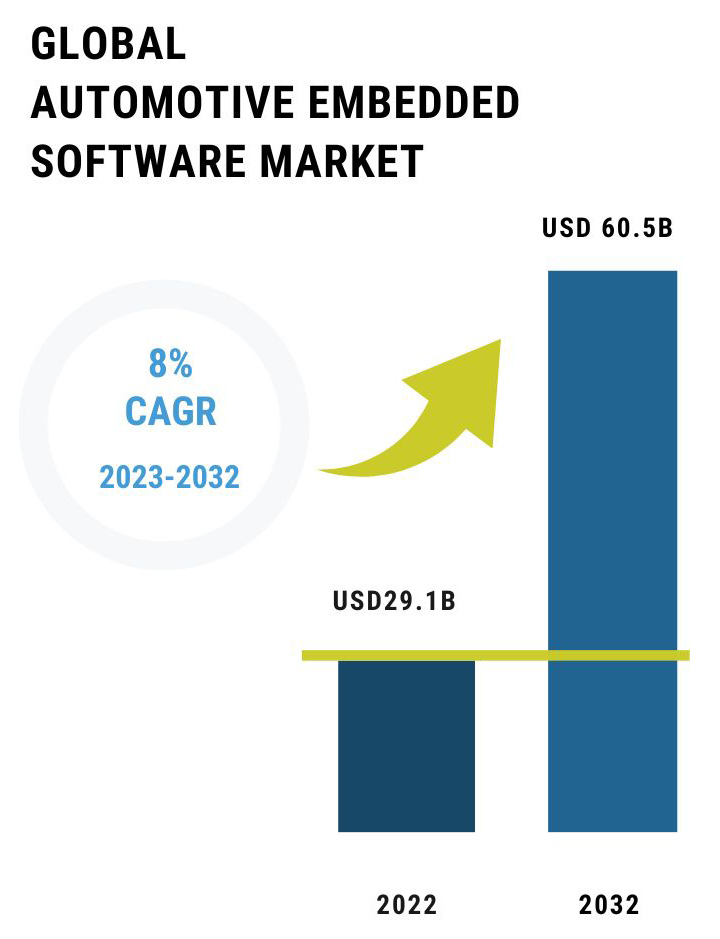

The automotive digital engineering market is evolving at a breakneck pace, fueled by the growing demand for smarter, software-defined vehicles. Embedded systems, electronic control units (ECUs), advanced driver assistance systems (ADAS), and autonomous driving technologies are no longer futuristic concepts - they're the backbone of modern automotive innovation. The global automotive embedded software market, valued at $29.1 billion in 2022, is projected to grow to $60.5 billion by 2032, growing at a robust 8% CAGR (2023 - 2032), as per recent research. Engineering R&D (ER&D) investments are pouring into automation, electrification, and next-generation infotainment solutions as automakers redefine mobility.

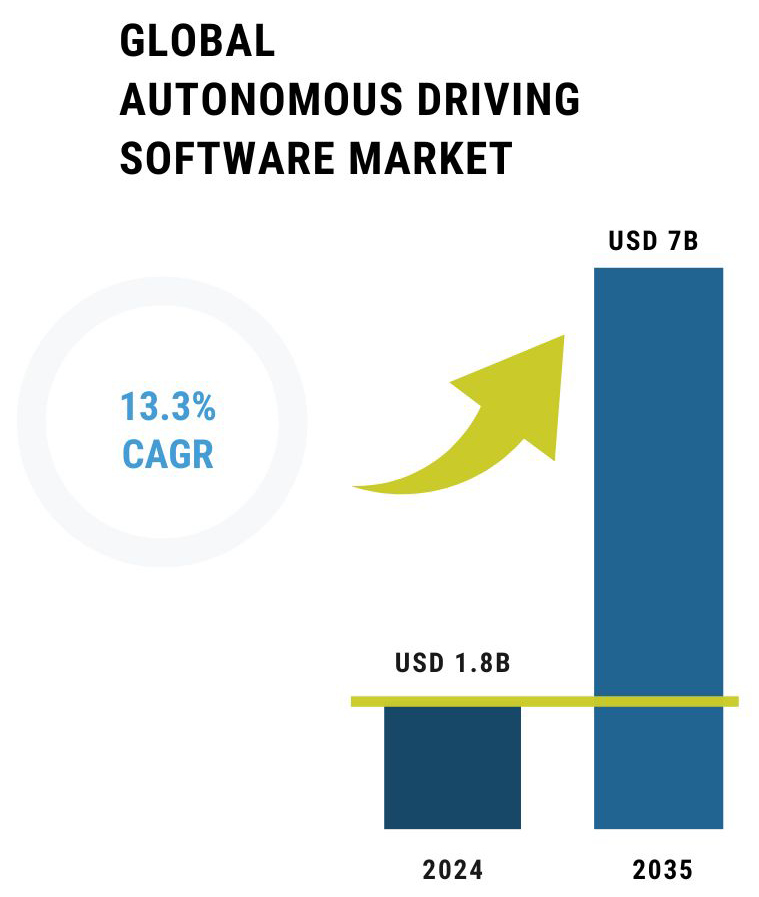

With OEMs moving toward fully connected and software-driven vehicles, the global automotive electronics market is set to surpass $462 billion by 2030 as per recent research. Meanwhile, the autonomous driving software market is expected to expand from $1.8 billion in 2024 to $7.0 billion by 2035, with a CAGR of 13.3%, as per recent research. The rapid integration of AI, IoT, and cybersecurity in automotive design is setting the stage for a major shift in the industry.

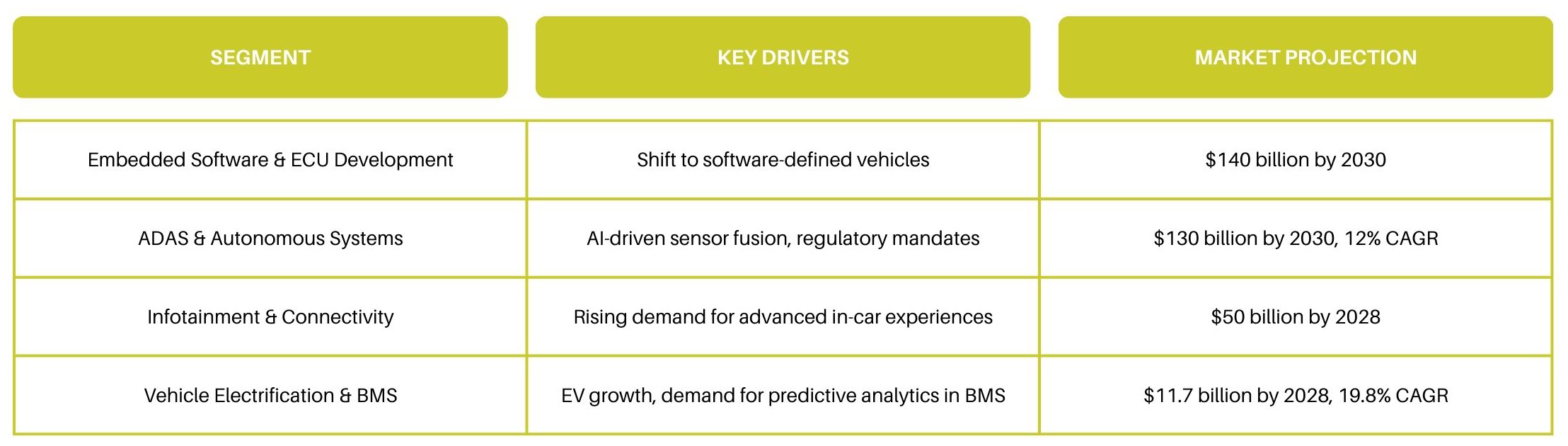

Key Market Segments & Growth Drivers

Emerging Trends in Automotive Digital Engineering

- AI & Machine Learning for Autonomous Driving: AI-powered perception, control, and decision-making models are making self-driving cars safer and more reliable.

- Edge Computing for Real-Time Data Processing: Reducing latency in autonomous driving, predictive maintenance, and cybersecurity enhances vehicle performance and safety.

- Automotive Cybersecurity: The rise of connected vehicles has led to a surge in demand for AI-driven threat detection and secure-by-design software architectures.

- Digital Twin Technology in Automotive R&D: Automakers are leveraging virtual simulations to optimize performance, test autonomous driving algorithms, and reduce production costs.

- Industry 4.0 in Manufacturing: AI-driven smart factories and IoT-enabled production lines are reshaping automotive supply chains, boosting efficiency, and lowering costs.

Key Players & Market Landscape

The automotive digital engineering market is a dynamic ecosystem where established giants and emerging players are reshaping mobility. Global leaders like Bosch, Continental, NXP Semiconductors, Texas Instruments, and Renesas Electronics dominate the space, providing the critical embedded systems and processors that power modern vehicles. These companies have built their reputations by delivering high-reliability solutions for electronic control units (ECUs), advanced driver assistance systems (ADAS), and autonomous driving platforms.

However, innovation in automotive digital engineering is not solely driven by the largest players. Niche firms such as Vector Informatik, Green Hills Software, and TTTech are at the forefront of specialized areas like cybersecurity, real-time systems, and safety-critical software. These companies cater to OEMs and Tier 1 suppliers who require hyper-specific solutions that enhance vehicle intelligence, security, and performance.

One of the biggest shifts in the market is the growing influence of software-focused companies. Tesla’s vertically integrated software approach has set new industry benchmarks, compelling traditional automakers to rethink their digital strategies. Volkswagen’s CARIAD and General Motors’ Ultifi platforms illustrate the shift towards in-house software development, while partnerships between traditional OEMs and tech giants like Waymo, Nvidia, and Qualcomm are accelerating advancements in artificial intelligence (AI) and connectivity solutions.

As the industry pivots toward software-defined vehicles, the alignment between automotive and technology companies continues to grow. Companies like Mobileye and Ambarella are making waves with AI-driven perception technologies, helping to advance autonomous driving capabilities. Meanwhile, cybersecurity firms are playing an increasingly crucial role as vehicles become more connected, ensuring that embedded systems remain resilient against cyber threats.

This convergence of traditional automakers, chip manufacturers, software specialists, and AI innovators is driving an unprecedented wave of transformation in automotive digital engineering.

M&A Landscape: Consolidation in Automotive Digital Engineering

Consolidation is shaping the automotive digital engineering market as established players seek to strengthen their capabilities through acquisitions. Companies are investing heavily in specialized firms to gain a competitive edge in critical areas such as autonomous driving, embedded systems, and vehicle connectivity. Bosch, a global leader in technology and services, plans to invest an additional ₹2,000 crore over the next five years in India. The investment will primarily focus on advancing automotive technologies and enhancing digital mobility solutions. Additionally, Bosch has committed to a 70-billion-forint ($240 million) investment in Hungary to expand its existing manufacturing facilities. This investment will be directed towards the development of next-generation automotive components, particularly for electric and autonomous vehicles. Meanwhile, Hyundai Motor Group has announced an $13 billion investment to integrate advanced software capabilities into all its vehicles, enabling regular software updates for its customers.

One of the major trends fueling M&A activity is the need for automakers and suppliers to fast-track their digital transformation. With the push for autonomous and electric vehicles intensifying, companies are acquiring niche firms with deep expertise in AI, semiconductor design, embedded systems, cybersecurity, and real-time processing. This allows them to integrate cutting-edge technologies without the need for long-term in-house development.

L&T Technology Services (LTTS), a global leader in Engineering and R&D services, has partnered with FORVIA, the world’s 7th largest automotive supplier, in a €45 million, five-year agreement to support FORVIA’s Clean Mobility division. They will continue working on internal combustion engine engineering while benefiting from LTTS’ expertise in Digital PLM initiatives and training programs via its Global Engineering Academy. This partnership strengthens FORVIA’s push for ultra-low emissions technologies while securing long-term career growth for transferred employees. It also enhances LTTS’ automotive engineering capabilities, reinforcing its leadership in the evolving mobility landscape.

Tech services companies are also making significant moves in the space. Large IT consultancies and engineering firms are acquiring automotive software development specialists to expand their presence in the mobility sector. This shift is evident in the growing number of deals where digital engineering firms are being integrated into multinational corporations to serve the automotive industry's growing software needs.

FPT and Siemens have signed a Memorandum of Understanding (MOU) to accelerate automotive software development and digital transformation globally. The partnership leverages FPT’s engineering expertise and Siemens’ low-code platform to drive innovation across smart infrastructure, green data centers, digital industrial solutions, and intelligent mobility. This collaboration aims to enhance software-defined vehicle development and strengthen next-generation digital solutions across industries.

The competition for dominance in software-defined vehicles is also driving partnerships and joint ventures. Traditional automotive suppliers are collaborating with semiconductor companies and cloud computing providers to build scalable platforms that enable over-the-air (OTA) updates, AI-driven diagnostics, and predictive maintenance solutions.

Valeo is expanding its North American software capabilities to meet rising demand for Software-Defined Vehicles (SDVs). With a new technical center in Queretaro, Mexico, opening in 2024, the team will grow to 300 engineers, with plans to reach 800. Backed by 30+ years of expertise, Valeo develops embedded software for ADAS, powertrain electrification, thermal management, and smart lighting. The Queretaro center will support central compute units, displays, lighting modules, and high-voltage systems, reinforcing Valeo’s leadership in next-gen mobility solutions.

As the market continues to mature, M&A activity will remain a key strategy for companies looking to establish leadership in the rapidly evolving automotive digital engineering space. Strategic acquisitions are no longer about expanding portfolios - they are essential for survival in an industry that is undergoing one of the most profound transformations in its history. Notable acquisitions below tells the tale:

KPIT Technologies, a leading independent software development and integration partner for the automotive and mobility industry, has signed a definitive agreement to acquire a controlling stake in PathPartner Technology, a specialist in operating system and low-level software for automotive, camera, radar, and multimedia devices. This acquisition strengthens KPIT’s software integration capabilities, enabling it to deliver complex software solutions for next-generation vehicle architectures. It also provides early access to semiconductor technologies through PathPartner’s centers of excellence, benefiting automotive OEMs and Tier 1 suppliers. Additionally, the acquisition enhances KPIT’s expertise in high-compute domain controller software, particularly in autonomous, connected, and electrification technologies, reinforcing its leadership in next-gen mobility solutions.

Arrow Electronics, Inc., a global provider of technology solutions, has expanded its Automotive Centre of Excellence (CoE) in Egypt to support the development of next-generation automotive products, by acquiring Avelabs, an automotive engineering services provider headquartered in Cairo, Egypt, with offices in Munich, Germany, and Troy, Michigan, U.S.A.. Avelabs specializes in AUTOSAR, functional safety, and cybersecurity, helping OEMs and Tier-1 suppliers accelerate product development. With this expanded CoE, Arrow aims to enhance its automotive electronics design capabilities, strengthening its position in the evolving electric, autonomous, and connected vehicle ecosystem. This move reinforces Arrow's commitment to driving innovation in automotive engineering services, providing greater value to customers and suppliers in the transportation sector.

Quest Global, a leading global engineering services provider, has acquired Adept, a product design house specializing in semiconductor, automotive, and hi-tech verticals. The acquisition strengthens Quest Global’s digital engineering capabilities, expanding its semiconductor offerings, embedded services, and expertise in ADAS, vehicle connectivity, integrated cockpits, and AUTOSAR toolkits. With locations in Bengaluru, Hyderabad, and Vizag, and a client base across India, China, and the United States, Adept enhances Quest Global’s footprint in India while expanding its global presence. This move enables Quest Global to scale operations and offer deeper, end-to-end product engineering solutions. By integrating Adept’s specialized expertise, Quest Global accelerates its ability to solve complex engineering challenges in the fast-growing semiconductor and automotive industries, reinforcing its position as a trusted global partner for cutting-edge product development.

These acquisitions illustrate the growing importance of strategic investments in specialized digital engineering, where small firms can drive innovation.

Future Outlook

The automotive industry is undergoing a software revolution. As OEMs pivot toward electrification, automation, and AI-driven mobility, digital engineering will become even more critical. Companies that embrace real-time data analytics, software-defined vehicles, and embedded security frameworks will lead the charge into the next decade.

Strategic partnerships, acquisitions, and continued investment in advanced software platforms will shape the future of mobility. The firms that innovate rapidly and integrate cutting-edge software into automotive systems will emerge as the dominant players in this evolving landscape.

SA Global Advisors (SA), a leading global investment banking firm specializing in strategic investments and M&A transactions in the Technology, Media, and Telecom (TMT) sectors, is at the forefront of enabling businesses to harness the transformative potential of Generative AI. With expertise in strategic investments, M&A transactions, and growth capital, SA empowers entrepreneurs and investors to scale innovation, optimize AI adoption, and drive sustainable growth. In a rapidly evolving AI landscape, success lies in strategic partnerships that unlock efficiency, scalability, and competitive advantage, positioning businesses to lead the next wave of digital transformation.

To share feedback on this blog or discuss transaction opportunities, please reach out to us at [email protected].

Newsletter Subscription

SubscribeREAD NEXT

- Opportunities in Generative AI: Fueling Innovation and Strategic Growth

- Digital Engineering: Powering Innovation & Growth Across Mission-Critical Industries

- Weaving the Future: How Data Fabric Powers Enterprise Transformation

- The Modernization Trinity: Unlocking Growth with Cloud, App and Data Modernization

- Thriving in the ServiceNow Ecosystem: Strategies for Growth 2.0

Subscribe

Stay current with our latest insights in your inbox.