M&A is no longer an option for businesses. It is an integral part of Digital growth strategy for a growing number of Digital Transformation leaders and mid-sized IT Consulting Services players looking to grow faster. A look at Accenture Interactive’s acquisitions of companies including Karmarama, The Monkeys, Fjord, Rothco and Droga5, shows that the company has rapidly grown its media, digital and creative credentials by bringing scores of agencies around the world under its wing. Capgemini’s acquisition of Altran has given it a leadership position with a full stack of capabilities across research and development (R&D) strategy, digital design, product engineering, manufacturing services, software development and integration. Salesforce’s $27.7 billion deal to buy Slack, gave it the silver bullet that it had been looking for to bolster its vision for the social enterprise. What is the one common theme in all the above acquisitions? It is the acceleration of digital transformation growth through acquisitions. The flavor of M&A is increasingly Digital today, but the strategy has been around in the Technology industry for decades; be it Google buying Android in 2005, Disney’s acquisition of Pixar in 2006, or Apple snapping up Beats in 2014, one clear outcome has been exponential growth leading to a dominant market position within the category.

Even the largest Tech companies that dominate multiple aspects of our lives- Amazon, Apple, Facebook and Google — haven’t reached here alone and in a short period of time. They invested in and acquired hundreds of companies over the past fifteen years to propel them to become some of the most powerful tech behemoths in the world. The current coronavirus pandemic has turbocharged demand across Technology sectors and helped create a favorable market for M&A as more Technology companies now adopt this route to long-term growth and value creation. As seen during the early part of 2021 (based on S&P Global Market Intelligence research), we saw a record number of M&A transactions - the highest in 3 years for the same Q1 timeframe. In our opinion, we expect this trend to continue through Q2 and the rest of 2021-22 as companies look for new avenues to speed up growth through acquisitions and expand their Digital and Technology capabilities.

Earlier this year, SA exclusively advised iLink Digital, a US-based client on its strategic acquisition of Salesforce Platinum consulting partner Dazeworks, in a move designed to create a collaborative growth model and expand the existing Digital Transformation portfolio with deep Salesforce Consulting capabilities. Through this acquisition, iLink has been able to accelerate its digital transformation strategy and acquire new capabilities to expand its footprint in the fast-growing Salesforce ecosystem.

As we continue to see an ever-larger number of Digital and Technology companies taking the M&A route to growth, there is an explosion in the diversity of companies who are looking to acquire. Where the initial wave of Digital and Tech M&A was driven primarily by large enterprises, we are now increasingly seeing this broader second M&A wave with higher participation from mid-market, publicly listed and privately held companies.

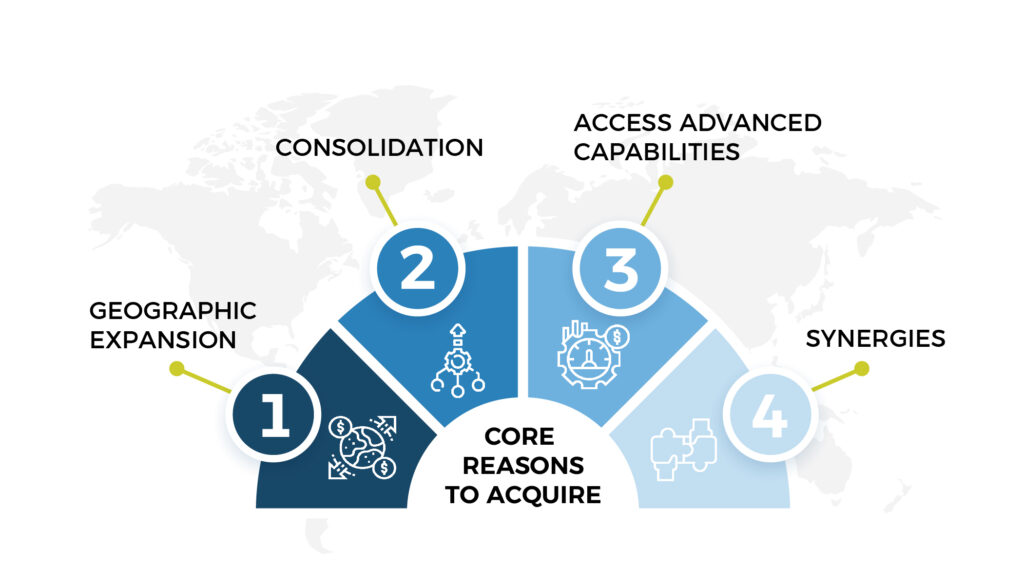

Over the past few years, SA has built specialised Buy-side M&A capabilities and offerings for mid-market Tech companies and private equity firms, who are looking to increase value through M&A. Based on our deep experience and perspective driving value for clients through M&A as well as from our own journeys of acquiring, successfully integrating and growing several tech companies, we broadly see the following as the top 4 reasons Technology companies look to acquire, rather than grow organically.

M&A offers the acquiring company an opportunity to quickly scale their customer base and revenue in a new Geography - for eg: the U.S. or Europe. With the current pace of innovation in the technology ecosystem, building a new product or solution organically, not only takes time but there are inherent risks to achieving a strong product or service market fit, market risk, and scale-related risks, which are important considerations for the acquirer to consider a Buy vs. Build approach. Ideally, the target company has completed the early phase of the growth journey and brings a few strong customers and strong capabilities which can be scaled with a large go-to-market and Geographic presence and scale from a strategic acquirer. Another example of market share expansion through acquisition is EPAM’s deal to buy Fathom Technology, a software development services company based in Budapest, Hungary, that helped EPAM expand its offshore capabilities and customers beyond North America.

In a rapidly evolving Digital Transformation ecosystem, a strategic acquirer can leapfrog the competition by making one or more acquisitions to quickly access Digital capabilities in new areas, where it may take simply too long to build organically or if the segment is fragmented and scale can be achieved through combining a few smaller players and creating new growth models. Sometimes, acquiring a company can be a sure method of establishing a lead or maintaining dominance in high growth, fast-evolving market. As the old adage goes- If you can’t beat them, buy them. By acquiring smaller, specialised players, a company not only gains access to distinctive capabilities through consolidation and scale coming in, but it can also leapfrog the competition and establish an early lead and over time build a long-term competitive advantage. Technology-focused Private Equity investors are increasingly adopting a similar approach in creating greater value for portfolio companies through specialised Digital acquisitions or investing new capital to create a roll-up or synergistic joining of forces with 2-4 smaller specialised players to create scale and long term value. Specific strategies may vary, but we see this momentum for Technology M&A accelerating over the next few quarters.

The one thing that has been a constant in the field of technology, is change. And companies that are not able to embrace this change, often do not survive. That’s why companies are often on the lookout to acquire other companies which give them new technologies and expertise. Oftentimes, strategic acquirers buy smaller companies to gain early access to unique technology capabilities that can help accelerate their growth strategy. Through such acquisitions, companies can get access to talent/skills and technologies at a faster pace or lower cost than organic efforts. If done right, most such acquisitions create significant value through expansion of the target company’s revenues by leveraging its larger sales channels and customer base to accelerate the growth of the acquired companies’ products and services. For instance, when Microsoft bought coding web network GitHub in 2018, CEO Satya Nadella said the acquisition will help GitHub to promote the company's own developer tools and use Microsoft sales teams to speed up the adoption of GitHub by its large enterprise customers. For example, Palo Alto Networks’ investment in DevOps security startup Bridgecrew for $156M allowed Palo Alto to offer developers security assessment and enforcement capabilities throughout the DevOps process, according to the company.

By combining business activities, overall performance efficiency tends to increase and across-the-board costs tend to drop, due to the fact that each company leverages off of the other company's strengths. Acquisition targets with compelling synergy opportunities have a higher intrinsic value to the acquirer. Synergies in most M&A transactions can be broadly categorized in 4 key areas:

- Revenue synergies: In M&A transactions, where revenue synergies are clearly identified, increase in value happens through an increase in sales volumes. . For example, Thoughworks’ investment in FourKinds has helped it utilise Thoughtworks global framework and agile practices for innovation to increase revenue by accelerating its own growth of creating future-proof ML-led digital products and services. On the other hand, In addition to estimating the expected revenue synergies from a deal, it is also important to consider their timing. If revenue synergies are expected to take five to 10 years to flow through, the probability of realizing them may be lower and the acquisition payback is longer.

- Cost Synergies: Cost synergy refers to reductions in operating costs due to increased efficiencies in the combined company after the merger of two companies. There are several common ways in which companies seek to extract cost synergies through mergers and acquisitions, such as headcount reduction by identifying functional duplication, reducing operating cost by consolidating offices and locations, consolidating suppliers &/or renegotiating supplier terms, Increasing utilization of capital assets such as factories, transportation, etc.

- Technology Synergies: Acquiring for technology synergies, enables the acquirer to combine their specific technology portfolio, go-to-market and strengths to further grow and monetize the newly acquired Technology capabilities by building a combined value proposition, go-to-market and synergies which could come from product/technology commercialization, investment in Intellectual property rights and technology transfer. This is clearly an area with significant potential for further empirical investigation and research.

- Financial Synergies: Sometimes the focal point in an M&A transaction is around Financial Synergies resulting from two organizations combining together. Typically, synergies come from the two companies improving financing activities to a level greater than when the companies were operating as separate entities. As a result, these two companies as a consolidated entity may not only achieve financial advantages in terms of reduced borrowing cost on loans( or paying less interest), but they may also see additional tax benefits. The larger combined balance sheet makes it easier to finance growth by increasing debt capacity at a reduced combined cost of capital.

- In such M&A situations, where the synergy opportunities are clearly identified, acquirers may offer a valuation premium and there may be additional management incentives linked to realisation of synergies post-deal, through an earn-out or other mechanisms.

The process of putting two companies together involves a wide range of complex issues and risks which need to be managed well to realise successful outcomes. All our buy-side M&A engagements at SA are designed to minimise these risks and deliver a disciplined approach to help drive inorganic growth through acquisitions, investments, or partnerships – a catalyst for accelerated growth in mid-market companies. We understand that mere agility without a robust strategy and disciplined approach to executing acquisitions, minority investments, or strategic partnerships could lead to months or years of precious top management time lost on either the wrong pursuits or missed opportunities. Our own experience combined with learning from successful serial acquirers in the Technology space, have inspired us to drive the best M&A outcomes for our clients and become their trusted advisors by helping them transform their growth journey.

Newsletter Subscription

SubscribeREAD NEXT

- Smart, Connected, and Autonomous: The Role of Digital Engineering in Next-Gen Vehicle

- Opportunities in Generative AI: Fueling Innovation and Strategic Growth

- Digital Engineering: Powering Innovation & Growth Across Mission-Critical Industries

- Weaving the Future: How Data Fabric Powers Enterprise Transformation

- The Modernization Trinity: Unlocking Growth with Cloud, App and Data Modernization

Subscribe

Stay current with our latest insights in your inbox.