In today’s data-driven world, Generative AI (GenAI) is emerging as a creative powerhouse, transforming industries with its ability to generate content such as text, visuals, multimedia, and audio. Once the domain of human creativity, GenAI is now enhancing and redefining workflows and customer journey through machine learning models capable of learning, adapting, and creating.

At its core, GenAI is a digital craftsman, trained on vast datasets to understand patterns, context, and intent. It can summarize complexity, translate languages, analyze sentiments, and design captivating media with efficiency and scalability, reshaping how businesses communicate, innovate, and engage audiences. GenAI delivers high-quality outputs at lower costs, enabling businesses to customize experiences, boost customer satisfaction, and drive brand loyalty.

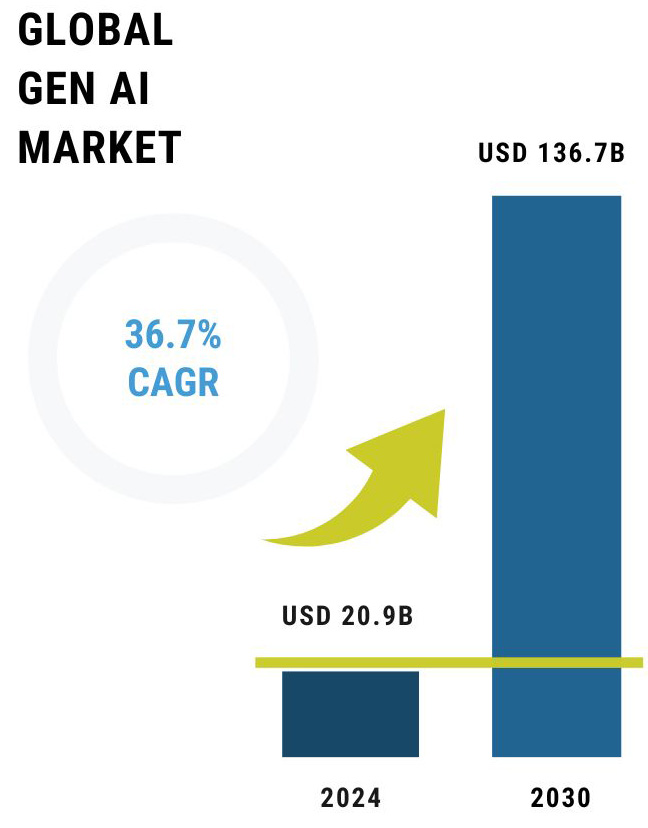

This technological shift has sparked a revolution, with the global GenAI market projected to grow from USD 20.9 billion in 2024 to USD 136.7 billion by 2030 at a CAGR of 36.7% according to Markets and Markets. This rapid expansion of the GenAI market is driven by key revenue drivers. These include infrastructure as a service for training Large Language Models (LLMs), digital advertising enhanced by AI-driven personalization, and specialized AI assistant software. The hardware sector is also anticipated to benefit from AI-optimized servers and storage, while computer vision AI products and conversational devices are also expected to generate significant revenue. These drivers highlight GenAI’s potential and its transformative impact across industries.

Unlocking Value for Enterprises across Industries

GenAI is emerging as a cornerstone of Digital Transformation, revolutionizing industries with its ability to streamline operations, enhance customer experiences, and unlock new revenue opportunities. At the heart of its impact lies an ecosystem of Model Providers, Tuners, and Consumers, enabling seamless integration of Gen AI into workflows. By addressing industry-specific challenges and delivering measurable results, GenAI has become indispensable for enterprises striving to stay competitive in an increasingly AI-driven world. The transformative potential of GenAI is evident across sectors like BFSI, healthcare, manufacturing, and retail, where its applications are driving operational efficiency, innovation, and financial gains, thus delivering transformative outcomes that resonate with both enterprises and investors. Here’s a sector-wise analysis of how companies across BFSI, healthcare, manufacturing, and retail/e-commerce are leveraging GenAI:

BFSI: Revolutionizing Customer Interactions and Financial Services

- Klarna: By integrating OpenAI’s GPT-powered assistant, Klarna automated two-thirds of customer inquiries, cutting response times from 11 to 2 minutes, reducing repeat inquiries by 25%, and projecting a $40 million profit in 2024.

- JPMorgan Chase: The bank’s innovative IndexGPT—a generative AI tool designed for wealth management—promises tailored investment advice, enabling better client-specific solutions.

Healthcare: Enhancing Patient Care and Accelerating Research

- Mass General Brigham: Leveraging GenAI, the healthcare leader handled 40,000+ patient inquiries in a week, easing hotline pressure. Additionally, nearly 1 in 10 doctors now use AI-powered tools for note-taking, enhancing accuracy and patient interactions.

- Insilico Medicine: Utilizing generative AI models, Insilico reduced early-stage R&D costs by 10% and shortened drug development timelines from years to just 18 months, revolutionizing drug discovery.

Manufacturing: Optimizing Design and Operations

- Autodesk Dreamcatcher: This GenAI-driven tool generates thousands of design prototypes based on input parameters, reducing prototyping costs by 30–40% and accelerating product development.

- Siemens: With GenAI-powered digital twins, Siemens enhanced workflow simulations and predictive maintenance, cutting downtime by 20% and improving operational efficiency.

Retail/E-commerce: Personalization at Scale

- Amazon: GenAI-driven recommendation engines contribute to 35% of Amazon’s sales, providing tailored product suggestions and boosting customer satisfaction.

- Stitch Fix: By leveraging GenAI, Stitch Fix delivers personalized styling recommendations, driving higher average order values and improving customer retention.

The image below highlights how the GenAI ecosystem—comprising Model Providers, Tuners, and Consumers— enables businesses to efficiently adopt and scale GenAI, leading to improved productivity, innovation, and competitive advantage.

Strategic M&A and Investments Powers Gen AI

As GenAI reshapes industries and unlocks new possibilities, companies are driving growth through strategic mergers and acquisitions (M&A) alongside a surge in private equity and venture capital investments. In 2024, PE/VC funding in GenAI exceeded $56 billion, nearly doubling from the $29 billion invested in 2023, according to S&P Global Market Intelligence. This rapid increase reflects the growing confidence in GenAI’s transformative potential across industries.

For strategic investors, acquiring GenAI companies is more than just expanding portfolios—it’s a means to enhance operational efficiency, accelerate innovation, and gain a competitive edge. By integrating advanced AI capabilities, businesses can shorten product development cycles, optimize decision-making, and scale AI-driven solutions faster. As a result, M&A and investment activity in GenAI is not just fueling sector growth but also shaping the next phase of AI-driven business transformation.

These transactions generate significant synergies that support strategic goals, some of which have been outlined below.

- Enhanced Capabilities: Acquisitions provide acquiring companies with specialized generative AI expertise, enabling the development of tailored solutions for specific industries.

- Geographic Expansion: Cross-border M&A activities allow companies to extend market reach into new regions, reinforcing global presence while localizing solutions to address region-specific needs.

- Client Value Creation: By integrating the unique strengths of acquired companies, businesses can deliver more comprehensive and innovative services, strengthening client relationships and loyalty.

- Strategic Alignment: Each acquisition aligns with the acquiring company’s vision of scaling AI capabilities, improving operational efficiency, and driving market leadership.

The surge in cross-border M&A activity underscores enterprises’ efforts to expand geographic footprints and penetrate new markets while strengthening AI capabilities. These acquisitions enable businesses to localize solutions, address region-specific needs, and differentiate offerings across industries. By aligning investments with strategic objectives, organizations realize synergies such as enhanced core competencies and stronger value propositions.

A few recent acquisitions and deals illustrated below showcase how acquiring GenAI companies drives innovation, enhances competitive positioning, and unlocks synergies that propel growth and long-term success.

Artefact, a European leader in data and AI consulting with over 1,500 employees across 22 countries, has acquired Effixis, a Switzerland-based AI consultancy specializing in Natural Language Processing (NLP) and Large Language Models (LLMs). Effixis, with a team of 50 employees, serves prominent clients such as Nestlé, Pictet, and Roche.

The acquisition enhances Artefact’s generative AI capabilities, leveraging Effixis’ expertise in NLP and LLMs, while also expanding Artefact’s presence in Switzerland and Belgium. Effixis’ Prompt University further strengthens Artefact’s position as a leader in AI education and workforce upskilling. This strategic move accelerates innovation, broadens market reach, and solidifies Artefact’s leadership in AI consulting across sectors like healthcare and financial services.

Accenture, a global professional services firm with 742,000 employees across 120+ countries, has acquired Parsionate, a Germany-based data consultancy with 130 professionals across Europe. Parsionate’s expertise in Master Data Management and Data Governance enhances Accenture’s AI capabilities in retail, life sciences, consumer goods, and industrial sectors while strengthening its European footprint.

The acquisition creates synergies by integrating Parsionate’s domain-specific expertise in AI-driven strategies, modern data foundation services for scalable adoption, and strong presence in Germany, Switzerland, and the Netherlands. Aligned with Accenture’s AI investment strategy, this move accelerates innovation, expands infrastructure readiness, and reinforces Accenture’s leadership in generative AI and data transformation.

Ascendion, a U.S.-based software engineering firm with over 6,000 employees, has acquired Nitor Infotech, an India-based software product engineering company with over 700 employees and a Generative AI Center of Excellence in Pune. Specializing in deep learning, prompt engineering, and cloud solutions, Nitor strengthens Ascendion’s capabilities in health-tech, retail-tech, and supply chain-tech industries.

The acquisition delivers key synergies by enhancing Ascendion’s ability to deliver innovative GenAI solutions, expanding its global delivery capacity, and aligning with its vision to lead in software product engineering. By integrating Nitor’s expertise, Ascendion accelerates innovation, scales service delivery, and solidifies its leadership in AI-driven solutions, serving 60+ clients across sectors. This move underscores how strategic M&A fosters growth, unlocks synergies, and drives competitive advantage in the AI economy.

The Road Ahead: M&A and Strategic Partnerships Shaping the GenAI Landscape

The GenAI market is poised for sustained growth, driven by mergers, acquisitions, and strategic partnerships to scale capabilities and accelerate innovation. M&A activity in the GenAI space reflects a broader strategy of consolidating expertise, infrastructure, and talent to stay ahead of the curve. An ISG study predicts how enterprise spending on GenAI initiatives is expected to increase by 50 percent in 2025 as compared to the last year, driven by a greater realization of ROI. This surge in investment underscores the growing confidence in GenAI’s potential to drive efficiency, customer service improvements, and business growth. As a result, future M&A activity will emphasize synergies between GenAI platforms and enterprises, enabling faster adoption and seamless integration. Moreover, companies that balance innovation with responsibility and focus on ethical governance, scalability, and regulatory compliance to ensure sustainable growth, are set to lead the next phase of GenAI evolution, shaping the future of business intelligence, automation, and creativity.

SA Global Advisors (SA), a leading global investment banking firm specializing in strategic investments and M&A transactions in the Technology, Media, and Telecom (TMT) sectors, is at the forefront of enabling businesses to harness the transformative potential of Generative AI. With expertise in strategic investments, M&A transactions, and growth capital, SA empowers entrepreneurs and investors to scale innovation, optimize AI adoption, and drive sustainable growth. In a rapidly evolving AI landscape, success lies in strategic partnerships that unlock efficiency, scalability, and competitive advantage, positioning businesses to lead the next wave of digital transformation.

To share feedback on this blog or discuss transaction opportunities, please reach out to us at [email protected].

Newsletter Subscription

SubscribeREAD NEXT

- Smart, Connected, and Autonomous: The Role of Digital Engineering in Next-Gen Vehicle

- Digital Engineering: Powering Innovation & Growth Across Mission-Critical Industries

- Weaving the Future: How Data Fabric Powers Enterprise Transformation

- The Modernization Trinity: Unlocking Growth with Cloud, App and Data Modernization

- Thriving in the ServiceNow Ecosystem: Strategies for Growth 2.0

Subscribe

Stay current with our latest insights in your inbox.