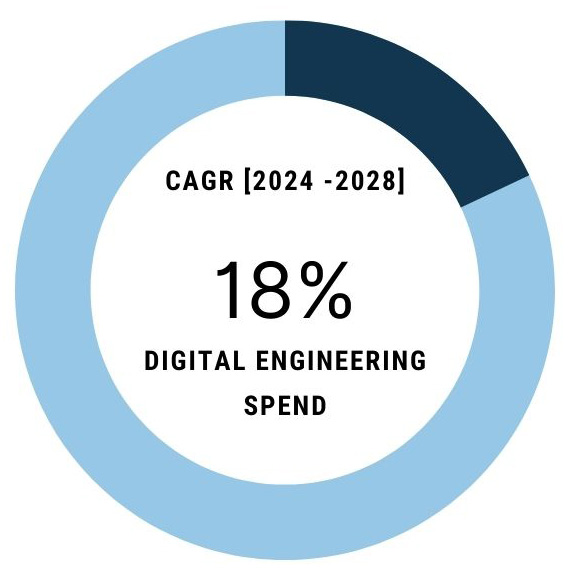

The Digital Engineering market has become a cornerstone of innovation across industries such as aerospace, automotive, healthcare, and high-tech. In the year 2022, the Global ER&D spend was at USD 1,811 billion, of which USD 810 billion was attributed to Digital Engineering spending. The Digital Engineering spend is expected to grow at a CAGR of approximately 18% from 2024 to 2028, according to Zinnov.

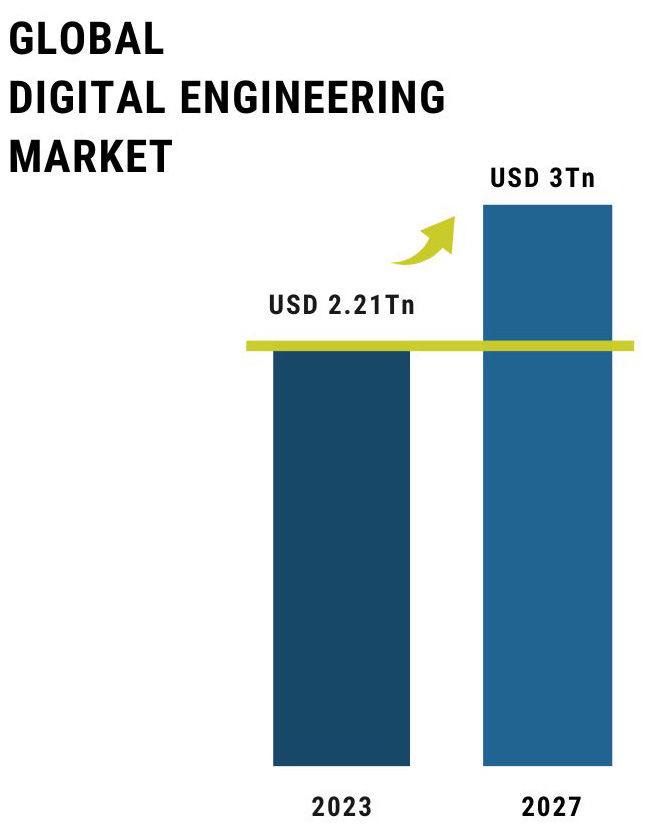

As per a recent research report, titled Digital Engineering Report 2024 by Zinnov, the global Digital Engineering (DE) market was valued at USD 2.21 trillion in 2023 and is projected to reach USD 3 trillion by 2027.

This exponential growth is underpinned by companies harnessing Digital Engineering to streamline operations, reduce costs, and meet evolving customer demands. These innovations span diverse sectors, transforming product lifecycles and fostering interconnected systems. The rise of smart factories, increasing adoption of Industry 5.0 principles, and the push for digital transformation post-pandemic are key drivers.

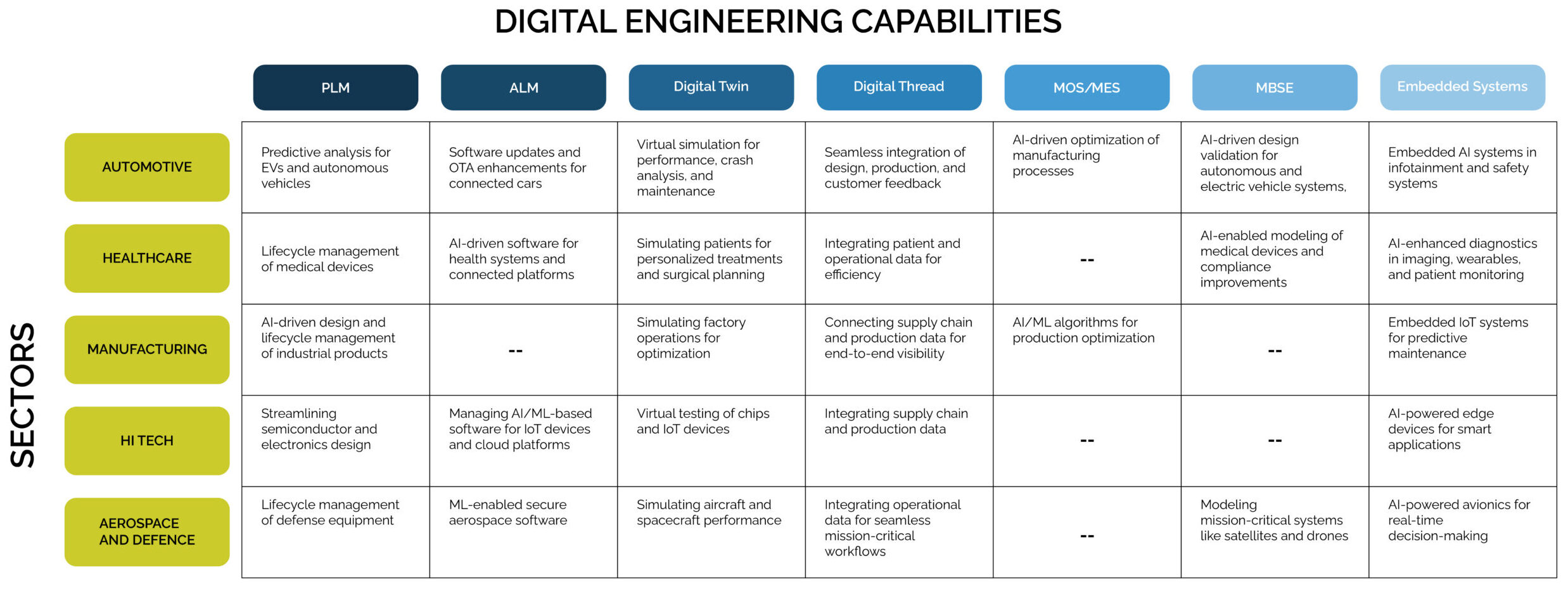

For example, in the aerospace industry, companies like Boeing and Airbus are utilizing Digital Twin technology to optimize aircraft performance and reduce maintenance costs. Similarly, the automotive industry—led by players such as Tesla and Volkswagen—relies on Digital Thread solutions to accelerate EV development and autonomous vehicle capabilities. In healthcare, Philips and GE Healthcare are deploying embedded engineering and AI-driven diagnostics to enhance patient outcomes. Companies like Medtronic are using connected devices to enhance diagnostics and remote monitoring capabilities. Finally, within the High-tech industry vertical, companies like Intel and NVIDIA are advancing chip design using PLM and ALM technologies, ensuring faster time-to-market for cutting-edge solutions.

Digital Engineering for Tomorrow: Core DE Capabilities leading Transformation of Industries

Digital engineering is reshaping industries, enabling smarter, faster, and more sustainable solutions. The integration of Digital Engineering services is creating a unified Digital Ecosystem that fosters innovation. As industries adopt advanced Digital Engineering solutions, they are collectively creating a digital fabric that integrates processes, systems, and data, enabling seamless collaboration and innovation.

BMW’s adoption of Siemens’ PLM tools has streamlined the development of electric vehicles. Microsoft’s Azure DevOps enables continuous delivery pipelines for IoT-driven solutions in high-tech industries, while Lockheed Martin leverages ALM for secure aerospace software development.

The above demonstrate how digital platforms, such as Siemens' PLM and Microsoft's Azure, are reshaping industry norms, driving efficiency, and unlocking new capabilities. Few more examples are:

- Raytheon, a leader in aerospace and defense, uses MBSE to model satellite systems, reducing design iterations.

- Tesla’s real-time autopilot systems and Medtronic’s embedded technologies for pacemakers exemplify how these services drive smarter solutions in automotive and healthcare.

- Companies like Rolls-Royce in aerospace use Digital Twins to predict engine performance, saving millions annually. In high-tech, semiconductor manufacturers utilize Digital Threads to ensure traceability and precision across fabrication processes.

- In automotive, Toyota’s implementation of MES solutions has enhanced production line efficiency, while Roche’s MES adoption in healthcare manufacturing has ensured compliance with stringent regulations.

Key players shaping the Digital Engineering Landscape

The significant growth opportunity in the Digital Engineering market has led to a few key players including Siemens, Dassault Systèmes, and PTC, renowned for their PLM and MBSE solutions, who are now well positioned to shape the Digital Engineering landscape. In embedded engineering, Bosch and Harman are among the leaders in automotive innovation, while Intel spearheads advanced high-tech chip design for future automotive applications. We see a significant opportunity for these market leaders to leverage solutions, platform architectures and Digital Engineering services through partnerships across industry verticals, wherein they are not just providers of software and tools; they are enablers of transformation across industries, enabling clients to address complex challenges. For instance, the partnership between Google Cloud and Philips, illustrates how the integration of AI into healthcare diagnostics can unlock exponential growth. Additionally, aerospace companies like Northrop Grumman are investing heavily in digital twin technologies to enhance mission-critical systems.

Powering Growth through M&A

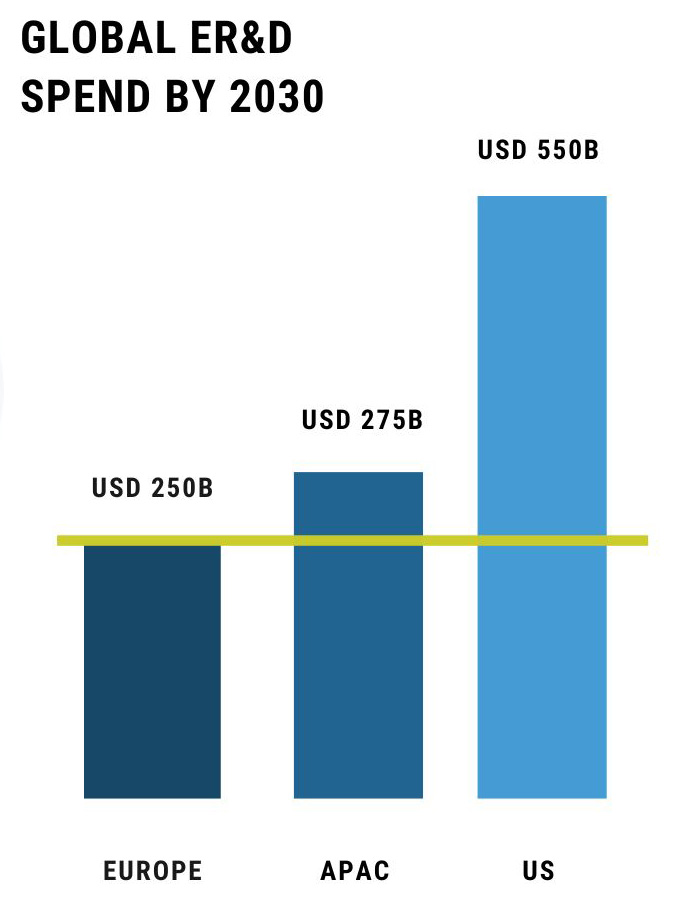

The Digital Engineering space has been marked by strategic acquisitions. M&A as a strategic growth lever, plays a crucial role in driving innovation, enabling companies to expand capabilities and realize growth rates far above industry averages while adapting to rapidly evolving technological demands. Increasingly, given the shift in demand across the automotive industry and adjacent verticals, the automotive industry is facing transformative headwinds, particularly in established markets like Germany, France, and the UK. While German automakers have historically excelled in building conventional cars, they lag behind in the rapidly growing EV segment, which demands expertise in automotive software and electronic components rather than traditional mechanical parts. This challenge is particularly pronounced in Europe, which accounts for over $250 billion of the global Engineering R&D (ER&D) spend, alongside the US ($550 billion+) and APAC (Japan, South Korea – ~$275 billion). While German developers and engineers remain among the global elite, there is a notable lack of flexibility, particularly at the management level, to attract new customer groups, such as tech-savvy young consumers in Asia.

This shift highlights the erosion of old paradigms and knowledge, which, while unfortunate, underscores the need for reinvention. German developers and engineers remain among the global elite, but there is a notable lack of flexibility, particularly at the management level, to attract new customer groups, such as tech-savvy young consumers in Asia. To remain competitive, companies must embrace cross-cultural collaboration, form strategic partnerships, and adopt transformative technologies like digital manufacturing and Industry 5.0. Beyond regulatory improvements, creative and courageous action from leadership is vital to navigate this dynamic era and position themselves for future growth.

Noteworthy transactions include:

ITI Group, headquartered in the UK with over 500 employees and 50 years of experience in real-time monitoring and information systems, has acquired Cimlogic, a UK-based Digital Manufacturing solutions provider with over 200 employees and operations in North America and Europe. This acquisition enhances ITI’s portfolio by integrating Cimlogic’s smart factory and digital transformation capabilities, including its proprietary RAISE™ methodology, into ITI’s expertise in simulation, predictive analytics, and safety systems. The combined entity will deliver an end-to-end portfolio of digital solutions to optimize manufacturing operations, reduce waste, improve efficiency, and enable smarter supply chains. By leveraging Cimlogic’s strengths, ITI aims to expand its global presence and help clients digitally transform their operations to remain competitive in a rapidly changing industrial landscape.

Akkodis, a global Digital Engineering company and part of the Adecco Group with over 10,000 employees, has acquired Progneur Technologies, an India-based PLM and Digital Manufacturing services specialist with more than 150 employees. Founded in 2008 and headquartered in Gurgaon, India, Progneur has a strong presence across Bangalore, Pune, and NCR Delhi, serving global OEMs and suppliers in the automotive and manufacturing industries. This acquisition strengthens Akkodis’ footprint in India and enhances its capabilities in Product Lifecycle Management (PLM), a critical component of Digital Enterprise and Smart Industry transformation. By integrating Progneur’s expertise and local client base, Akkodis aims to deliver enhanced digital transformation solutions across its major industries while supporting its multi-location growth strategy and expanding its global network of delivery centers.

Atos, a global digital transformation leader headquartered in France with over 10,000 employees, has acquired Processia, a PLM and Digital Manufacturing services specialist headquartered in Canada with over 200 employees. Founded in 2000, Processia has established itself as a key player in the Product Lifecycle Management (PLM) domain, particularly with Dassault Systèmes’ 3DEXPERIENCE platform. The acquisition enables Atos to provide comprehensive digital transformation solutions, connecting PLM with ERP, MES, and CRM platforms to deliver a seamless Digital Thread. Leveraging Processia’s capabilities in data migration, 3DEXPERIENCE integration, and legacy system modernization, Atos aims to enhance its ability to support manufacturers adopting Industry 4.0 technologies.

Arcfield, a government services and mission support provider headquartered in Chantilly, VA, with over 1,300 employees, has acquired Strategic Technology Consulting (STC), a Digital Engineering and model-based systems engineering (MBSE) solutions provider based in Toms River, NJ, with more than 110 employees. STC will operate as a subsidiary of Arcfield, continuing to serve its commercial and government clients with expertise in digital twins, MBSE-as-a-Service, and integrated digital engineering environments (IDEE).

This acquisition enhances Arcfield’s capabilities in advanced MBSE and digital engineering, supporting the transition of its clients from traditional systems engineering to all-digital models.. The combination strengthens Arcfield’s offerings in space and cyber defense, hypersonic systems, and national security, while also expanding STC’s market reach and customer base in the defense and commercial sectors. This strategic alignment positions Arcfield as a leader in MBSE and Digital Engineering services, catering to evolving needs in mission-critical industries.

Synergizing Success: The Role of Strategic Partnerships

Collaborations are driving innovation at the intersection of technology and engineering. Strategic partnerships are transforming how industries address technological and operational challenges, driving the integration of Digital Engineering into everyday processes. Notable developments include:

- General Motors partnering with Microsoft to develop autonomous vehicles using Azure’s cloud and AI capabilities.

- Siemens and NVIDIA collaborating on the Industrial Metaverse, leveraging Digital Twin technologies for aerospace and high-tech industries.

- GE Healthcare partnering with AWS to deploy cloud-based diagnostic tools, enhancing healthcare delivery. These partnerships exemplify the cross-industry convergence of expertise to tackle emerging challenges.

Growth in Digital Engineering is fueled by leveraging synergies across service lines. Building on the market momentum, companies are strategically scaling their Digital Engineering capabilities to meet increasing demand for integrated solutions. Companies like Capgemini have successfully cross-sold PLM and ALM services to automotive clients, creating end-to-end solutions. The increasing demand for integrated offerings drives higher valuations in the Digital Engineering business. For example, the aerospace sector is leveraging M&A to enhance capabilities in Digital Twins and predictive maintenance, while automotive companies are focusing on acquisitions to advance electric and autonomous vehicle development. Cross-selling opportunities in these domains ensure diversified revenue streams and long-term sustainability. As companies tap into cross-sector synergies, they are better positioned to meet growing market demands, strengthen competitive positioning, and secure sustainable growth trajectories.

Future Outlook

The M&A outlook for Digital Engineering in Automotive, Healthcare, and Defense in 2025 reflects steady potential. Investors are drawn to firms capable of scaling through M&A and partnerships, with high returns anticipated in aerospace, automotive, healthcare, and high-tech verticals. Key sectors driving this growth include Healthcare & Medical Devices ($460–620 billion, growing at 8–9% CAGR), Automotive ($460–540 billion, growing at 8–9% CAGR), and Aerospace & Defense ($90–120 billion, growing at 7–8% CAGR). Additionally, Semiconductors ($220–290 billion, growing at 9–10% CAGR) and Industrial sectors, including Construction ($250–280 billion, growing at ~8–9% CAGR), showcase promising opportunities in Digital Engineering advancements.

To thrive in a competitive market shaped by geopolitical challenges and natural disruptions, enterprises must prioritize adaptability and innovation in product development. The shift toward digitization and continuous advancement within traditional product life cycles is essential for modern product engineering. By integrating cutting-edge software engineering practices, organizations can stay ahead of the curve. Digital engineering remains a bright spot for growth in 2025, with the majority of companies looking to expand through strategic acquisitions. The emphasis is on rapidly acquiring difficult-to-build capabilities, enabling them to stay competitive in a fast-evolving market.

SA Global Advisors (SA), a leading global investment banking firm specializing in strategic investments and M&A transactions in the Technology, Media, and Telecom (TMT) sectors, empowers entrepreneurs and investors to capitalize on this transformation. By providing growth capital and facilitating partnerships and acquisitions, SA supports businesses in realizing their vision for the digital age.

The future of Digital Engineering lies in its ability to seamlessly integrate technology, people, and processes. By adopting a holistic approach, industries can achieve unparalleled growth, sustainability, and efficiency.

To share feedback on this blog or discuss transaction opportunities, please reach out to us at [email protected].

Newsletter Subscription

SubscribeREAD NEXT

- Smart, Connected, and Autonomous: The Role of Digital Engineering in Next-Gen Vehicle

- Opportunities in Generative AI: Fueling Innovation and Strategic Growth

- Weaving the Future: How Data Fabric Powers Enterprise Transformation

- The Modernization Trinity: Unlocking Growth with Cloud, App and Data Modernization

- Thriving in the ServiceNow Ecosystem: Strategies for Growth 2.0

Subscribe

Stay current with our latest insights in your inbox.