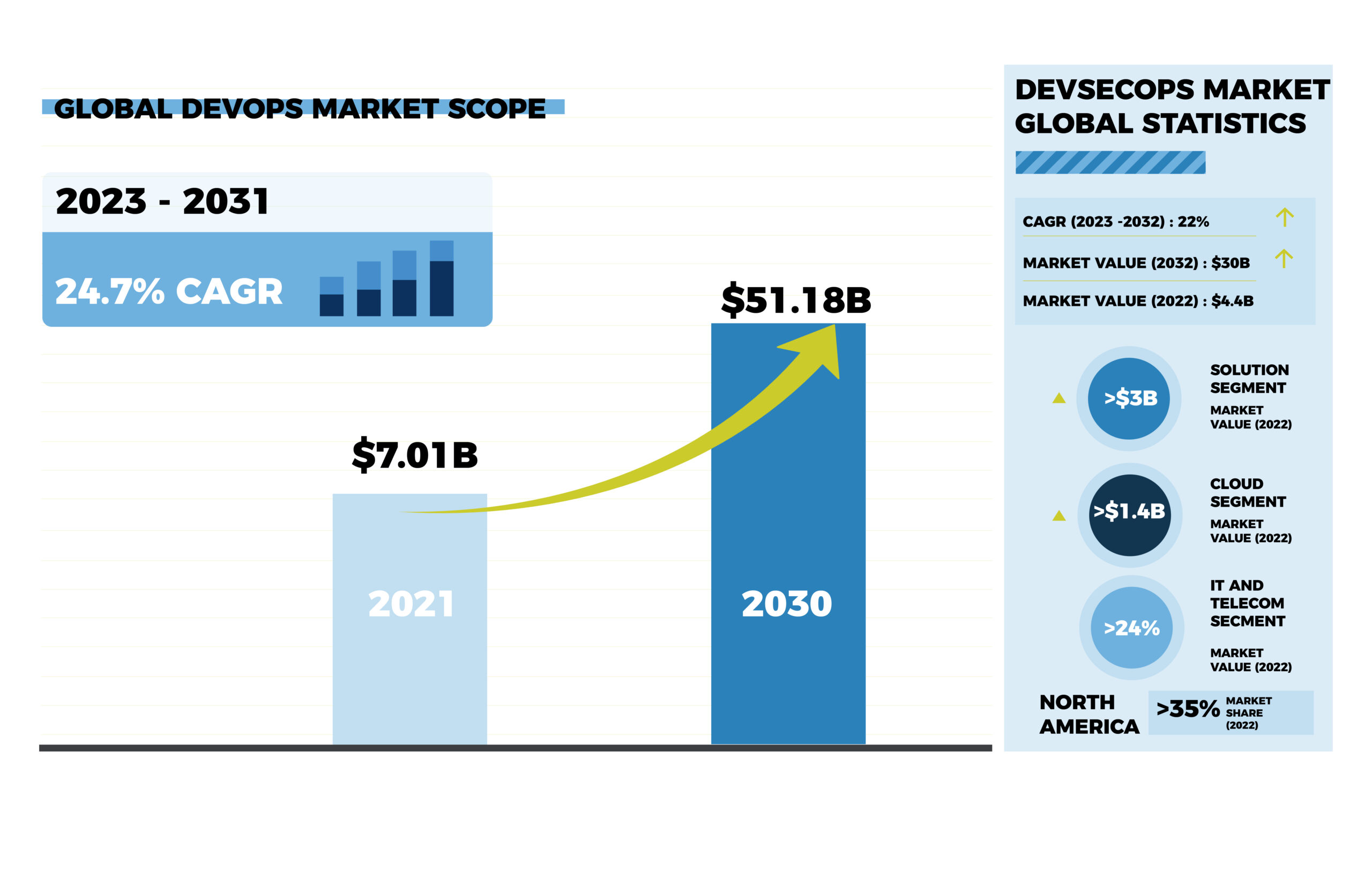

In 2023, enterprise DevOps continues to witness further development and broaden its influence on business by prioritising agile, lean practices, improving collaboration between operations and development teams and implementing automation tools to leverage an increasingly programmable and dynamic infrastructure from a software life cycle perspective. Enterprises and product innovators are increasingly embracing DevOps over the waterfall model to make their systems more agile, facilitate easier risk management and better customer engagement. According to a recent market study from Verified Market Research, the DevOps market is projected to surpass USD 51.18 Billion by 2030, exhibiting a growth rate of 24.7% from 2023 to 2030.

As DevOps promotes swift and reliable software development and delivery while enhancing quality and customer satisfaction, it continues to evolve in order to effectively address the evolving requirements of businesses. The impact of metrics such as deployment frequency on user attraction and retention is becoming increasingly evident over the past three years. As per the 2022 Testing in DevOps Report, teams that achieved a 50%-100% increase in deployments were likely to report 2.5x times greater user satisfaction. Moving forward, the ability to innovate while ensuring a defect-free user experience represents the next milestone for successful DevOps implementation.

In 2019, Microsoft acquired GitHub, while IBM acquired RedHat. These strategic moves disrupted the DevOps landscape. Looking ahead to 2024 it is expected that the momentum in this sector will not diminish. Companies such as Amazon, Facebook, and Salesforce are likely to persistently acquire open-source platforms and capabilities and along with such acquisitions, diverse software ecosystems. A recent report notes that DevOps accounted for the highest proportion of M&A activity in 2022. This trend stems from the recognition of DevOps as the upcoming transformative force, and strategic investments in this area are expected to yield accelerated RoI.

Investors, this year, are aiming to capitalise on mid-market opportunities, where they can either immediately deploy capital for continued high growth or inject liquidity into cash-strapped companies in the DevOps, cybersecurity, data analytics, and automation capability spectrum. The following are some of the recent 2023 acquisitions in the DevOps space:

- Dell acquired Cloudify for about $100 million following the sale of its stake in VMware. Dell invested in this Israeli startup to focus on cloud orchestration and infrastructure automation. Cloudify's tools will assist cloud architecture and DevOps engineers in managing containers, workloads, and hybrid environments. Dell aims to integrate its offerings with public cloud providers like AWS, providing both software and hardware solutions in the cloud environment.

- McKinsey acquired MLOps platform Iguazio for $50 million to bolster its machine learning capabilities. The plan is to integrate Iguazio into QuantumBlack, a McKinsey business unit focused on AI. Iguazio is known for its MLOps platform and open-source tools, MLRun and Nuclio, which facilitate ML pipeline orchestration and real-time serverless functions for application deployment automation.

- ThoughtFocus, a portfolio company of H.I.G. Capital acquired BreakFree Solutions to benefit from the target’s expertise in product development, cloud enablement, and DevOps implementation. The main motive of the partnership is to expand geographical reach and provide end-to-end services throughout the digital transformation lifecycle for clients in the financial sector.

As we foresee investment opportunities to remain buoyant within the sector, there are essentially four key DevOps trends and M&A activity drivers that investors are expected to consider in 2023 and 2024:

1) Expansion of DevSecOps-Agile Security

In response to the evolving landscape of cyber threats, companies are placing greater emphasis on continuous security and compliance. A study conducted by Check Point reveals a 38% rise in global cyber attacks in 2022 compared to 2021. To address this, organisations are ramping up their investments in AppSec, with projected spending reaching $7.503 billion in 2023, a substantial 24.7% growth compared to the previous year. In the year 2023, more investors are expected to enhance their security stance while simultaneously improving the agility of their software development and delivery pipelines. According to Global Market insights, the DevSecOps market was valued at USD 4.4 billion in 2022 and is projected to grow at a CAGR of 22% from 2023 to 2032.

2) AIOps, MLOps and DataOps- Integration of AI and ML

According to Mordor Intelligence, the AIOps market, at $21.97 bn in 2023, is predicted to reach $64.44 bn by 2028, with a 24.01% CAGR during 2023-2028. Hence, the use of AI and ML in DevOps will grow in automated testing, continuous deployment, and monitoring to optimise workflows, automate tasks, and enhance software development efficiency. Investors are increasingly incorporating ML algorithms to analyse code changes, predict real-time conflicts, and provide recommendations for better code quality. This helps monitor application performance, detect anomalies, and improve the user experience, hence streamlining processes and improving software quality. This was observed in a Github survey in 2022, where 47% of teams reported automated testing, up from 25% last year and by Gartner, which predicts 40% of DevOps teams will augment infrastructure monitoring with AI for IT Operations by 2023.

3) Containerization and Cloud Native Technologies

The application container market was valued at $2.76 bn in 2021 and is expected to reach $33.86 bn by 2030, with a 32.12% CAGR from 2023-2030. Kubernetes, Docker, and microservice architecture have revolutionised the development, deployment, and scaling of applications. A research by Forrester suggests that 71% of DevOps adopters use microservices and containers. These technologies empower DevOps teams to work with enhanced agility, creating demand for investment in:

- Kubernetes, an open-source container orchestration platform, enables seamless deployment, management, and scalability of containerized applications. It offers a flexible and scalable solution for handling complex distributed systems. DevOps teams can leverage Kubernetes to deploy applications quickly across public, private, and hybrid clouds. The global Kubernetes Solutions market was valued at $2013.0 mn in 2022 and will reach $6117.0 mn in 2028, with a 20.35% CAGR during 2022-2028.

- Docker, a containerization platform, allows developers to package applications and their dependencies into lightweight and portable containers, across diverse platforms. With Docker, DevOps teams benefit from a reproducible development environment, facilitating faster application development and testing. The global docker monitoring market is expected to grow at 17.8% CAGR from $ 540 mn in 2022 to $ 2.8 bn by 2032.

- Microservice architecture breaks down complex applications into smaller, independent, flexible and scalable units, contrasting with the traditional monolithic architecture, where even small changes require deploying a new version of the entire application. A recent Service Mesh Adoption Survey revealed that 85% of organisations are transforming their applications to a microservices architecture and such rapid growth and adoption will aid in helping microservices go mainstream.

4) Growth of Low-Code/No-Code Applications and Platforms

Low-code and no-code application platforms are expected to grow 25% to $10 bn in 2023 and to $12.3 bn in 2024, according to Gartner. LCNC platforms enable IT investors to swiftly assemble new processes and develop applications without extensive scripting, research, or testing. LCNC platforms incorporate monitoring, resource management, and advanced tools that streamline the DevOps process. Modern LCNC solutions empower app developers with greater freedom to customise layouts, fonts, templates, and designs. 70% of new applications developed will use LCNC — up from 25% in 2020.

The synergy of LCNC solutions with DevOps would help enterprises and product innovators in:

- Reducing workloads and alleviating stress for professional developers, IT teams, and software organisations as a whole.

- Allowing developers to assume more strategic roles within the enterprise, focusing on higher-value tasks rather than routine coding.

- Accelerating innovation via faster app development & deployment cycles.

- Creating new roles and opportunities within the development landscape.

- Facilitating rapid feedback from end-users, which is essential for the success of applications and business initiatives.

With the rise in cloud-native tools, demand for acquiring DevOps capabilities through M&A is projected to bounce back in H2 2023 and 2024 after the M&A boom of 2021 and 2022. However, according to Gartner, “enterprises struggle to manage the overall requirements for, and technical debt within, the DevOps toolchain across complicated hybrid cloud environments”. Creating hybrid cloud pipelines requires integrating on-premises infrastructure with public and private cloud services. To address this headwind, investors and targets in 2023 are encouraged to provide training, promote automation, facilitate collaboration, and establish clear processes. These measures would help I&O leaders effectively deliver software in hybrid cloud environments, allowing transformative developments and M&A activity in the DevOps market.

Newsletter Subscription

SubscribeREAD NEXT

- Smart, Connected, and Autonomous: The Role of Digital Engineering in Next-Gen Vehicle

- Opportunities in Generative AI: Fueling Innovation and Strategic Growth

- Digital Engineering: Powering Innovation & Growth Across Mission-Critical Industries

- Weaving the Future: How Data Fabric Powers Enterprise Transformation

- The Modernization Trinity: Unlocking Growth with Cloud, App and Data Modernization

Subscribe

Stay current with our latest insights in your inbox.