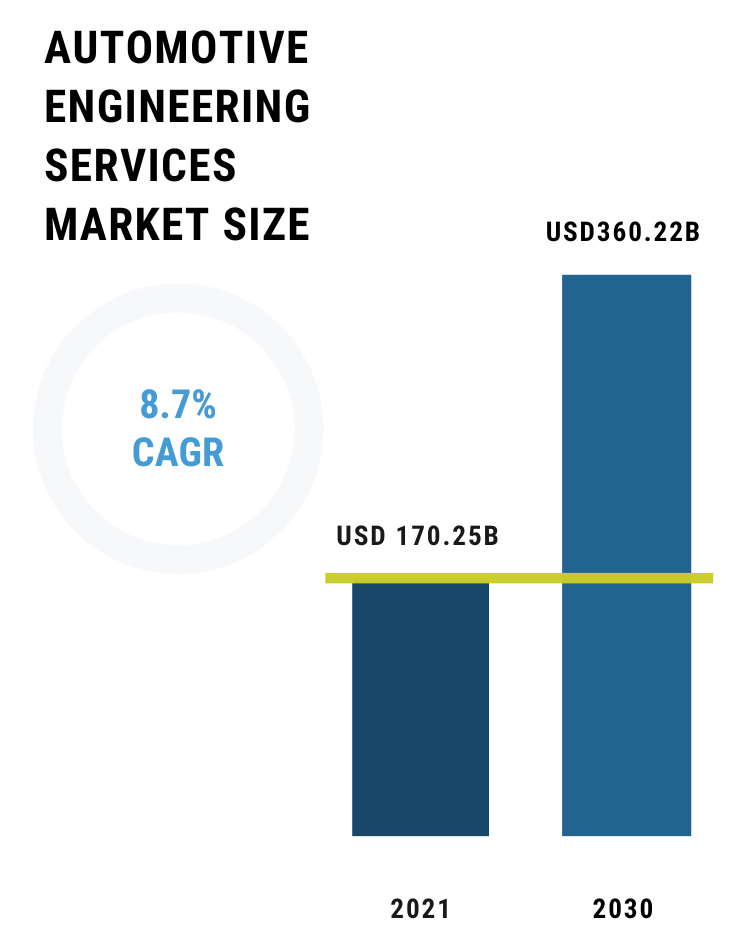

At the forefront of a revolutionary shift, the automotive industry is transitioning from a focus on wheels to one on code. Software, once a minor component in vehicles, now plays a pivotal role, akin to a car's central nervous system. As we enter 2024, the automotive engineering services market, a rapidly evolving sector within the automotive industry, is experiencing a significant shift driven by growth in the automotive software market and demand for software-driven services capability across the ecosystem. This particular segment, emerging as a cornerstone of vehicle functionality and driving experiences, is helping companies build advanced engineering services capabilities to transform automobiles into sophisticated data centers. According to Precedence Research, in 2021, the global market size for Automotive Engineering Services stood at USD 170.25 billion, and it is projected to surge to USD 360.22 billion by 2030, expanding at a CAGR of 8.7%.

The automotive software market, a key driver of this growth, is redefining mobility through enhanced software and digital features. This includes advanced connectivity solutions, such as cutting-edge navigation systems, smart infotainment, improved passenger safety, and efficient remote diagnostics. As we progress through 2024, the focus increasingly shifts from traditional mechanical components to software-driven innovation.

This trend presents vast opportunities for firms specializing in automotive software and building advanced software engineering capabilities. There are several large organizations actively pursuing growth strategies such as revenue partnerships, strategic investments, and mergers & acquisitions (M&A) to bolster their presence in this burgeoning segment.

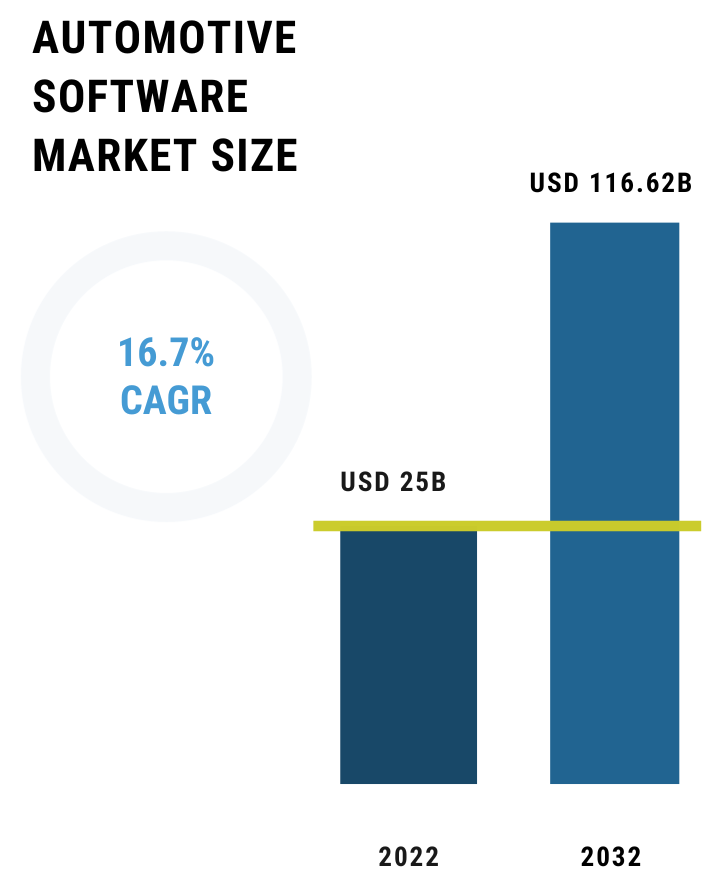

The automotive software sector stands at the forefront of this transformation, playing a pivotal role in shaping the future of the automotive industry.The market continues to see rapid growth, with a demand for solutions catering to complex next-generation vehicles. Valued at approximately USD 25 billion in 2022, the market is anticipated to reach around USD 116.62 billion by 2032, growing at a CAGR of 16.7%, as per Precedence Research.

This growth is driven by electrification, connectivity, autonomous driving, and shared mobility. The ADAS and AD software segment, which dominated the market in 2022 with over 20% of global revenue, is expected to double, highlighting the focus on autonomous capabilities in modern vehicles.

Market Trends - Shift towards E/E Architecture, Software Platforms and V2X

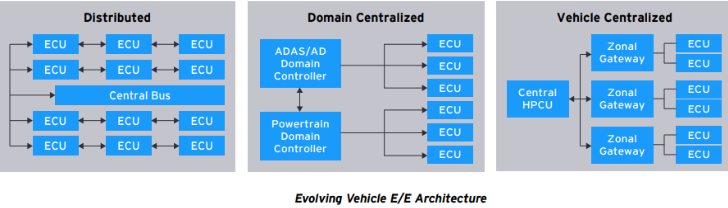

Technological advancements are reshaping the R&D landscape in the automotive sector. The shift towards centralized electrical/electronic (E/E) architectures, cloud ecosystems, and over-the-air (OTA) updates is gaining prominence.

The E/E architecture has evolved from distributed and domain-centralized systems to a future vehicle-centralized architecture.

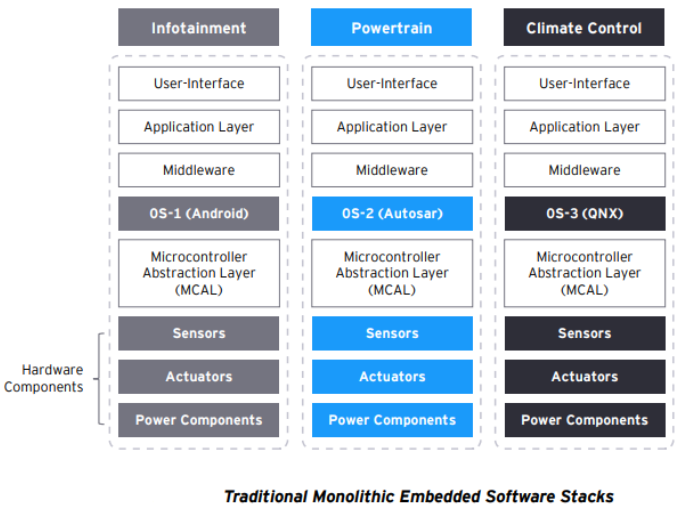

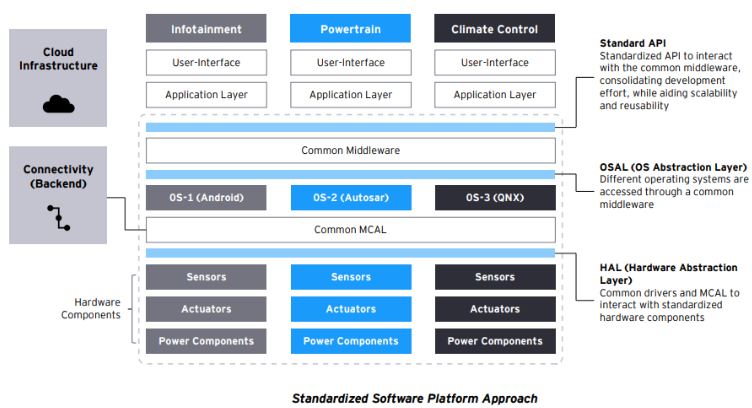

This evolution supports the development of standardized software platforms, replacing the previous approach of integrating software into hardware.

The new architecture introduces horizontal integration between software layers, allowing the development of high-level applications that are independent of the underlying hardware.

The latest generation of vehicle architectures and software platforms will better utilize cloud computing and Vehicle-to-Everything (V2X) connectivity. This brings enhanced connectivity features to automobiles, including low-latency, high-reliability communication, real-time interactions with surrounding smart infrastructure (Vehicle-to-Infrastructure, V2I) and other vehicles (Vehicle-to-Vehicle, V2V), and faster software updates.

In sync with the move towards a more consolidated E/E architecture, a centralized software platform is catalyzing the emergence of a novel software market. This new paradigm resembles app stores for prevalent mobile platforms, reducing entry barriers for dedicated software enterprises into the automotive realm.

In sync with the move towards a more consolidated E/E architecture, a centralized software platform is catalyzing the emergence of a novel software market. This new paradigm resembles app stores for prevalent mobile platforms, reducing entry barriers for dedicated software enterprises into the automotive realm.

- Evolving E/E Architecture's Impact: Standardized software platforms will replace the previous integration of software into hardware, facilitating cross-functional capabilities like Full Self-Driving (FSD).

- Advantages of Software-Defined Vehicles (SDVs): SDVs allow for a horizontally integrated software architecture, decoupling high-level application development from specific hardware constraints.

- Benefits of Centralized Software Platforms: A centralized platform fosters a new software market within automotive, akin to mobile app stores, by lowering the barrier to entry for pure-play software companies.

- Global OEMs' Shift to Software Platforms: Leading OEMs are adopting software platform approaches, which must be supported by a corresponding centralized vehicle E/E architecture.

- Role of 5G in Automotive: 5G's low latency and high bandwidth enable cloud offboarding for non-critical applications and processes, enhancing real-time connectivity and cloud integration.

- Enhancements in ADAS/AD: Utilization of cloud-based simulations to refine ADAS and AD functionalities.

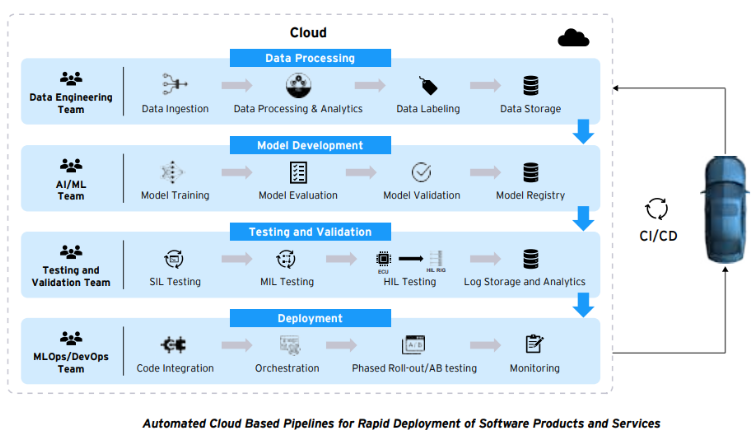

- Deployment and OTA Updates: Regular updates and software enhancements to vehicles through automated pipelines.

- MLOps: Streamlining machine learning models' deployment and maintenance for automotive applications.

- Data-Driven Organizations: Leveraging vehicle data for R&D, manufacturing, after-sales services, and value chain innovation.

- Next-Generation Vehicle Architectures and Connectivity: New vehicle architectures and software platforms facilitate the adoption of cloud computing and V2X connectivity, with 5G playing a pivotal role in real-time interactions with infrastructure and other vehicles.

The potential for growth in this arena is substantial, as these technologies are not just enhancements but foundational elements for the vehicles of tomorrow.

Automotive software technologies market is abundant of latest developments, products and R&D initiatives, each with a few key players, who are pioneering new initiatives in various sub-markets of the broader automotive software ecosystem:

- Infotainment and Telematics: Companies like GlobalLogic, and Tech Mahindra are carving a niche with connected services and in-car entertainment, focusing on user experience and seamless connectivity. The infotainment & connectivity segment is estimated to register the fastest CAGR growth of over 14.2% during the forecast period.

- Autonomous Driving: Entities like Aptiv and NVIDIA are at the forefront, developing advanced driver-assistance systems (ADAS) and self-driving algorithms.

- Electric Vehicle (EV) Software: Firms like KPIT and Tata Elxsi are innovating in battery management systems and charging solutions to support the EV boom. L&T Technology Services Limited (LTTS) is partnering with an American automotive supplier as a strategic partner to provide engineering services for their electric vehicle (EV) and power electronics products. LTTS will establish a center of engineering excellence, which will be utilized by their global technology teams in North America, Europe, and Asia.

- Vehicle Management Systems: Companies such as HCL Technologies and Capgemini are creating software for fleet management, diagnostics, and predictive maintenance.

- Simulation Softwares: Tata Consultancy Services (TCS) India and Ansys are collaborating with U.S.-based engineering simulation software providers to advance Electric Vehicle technology.

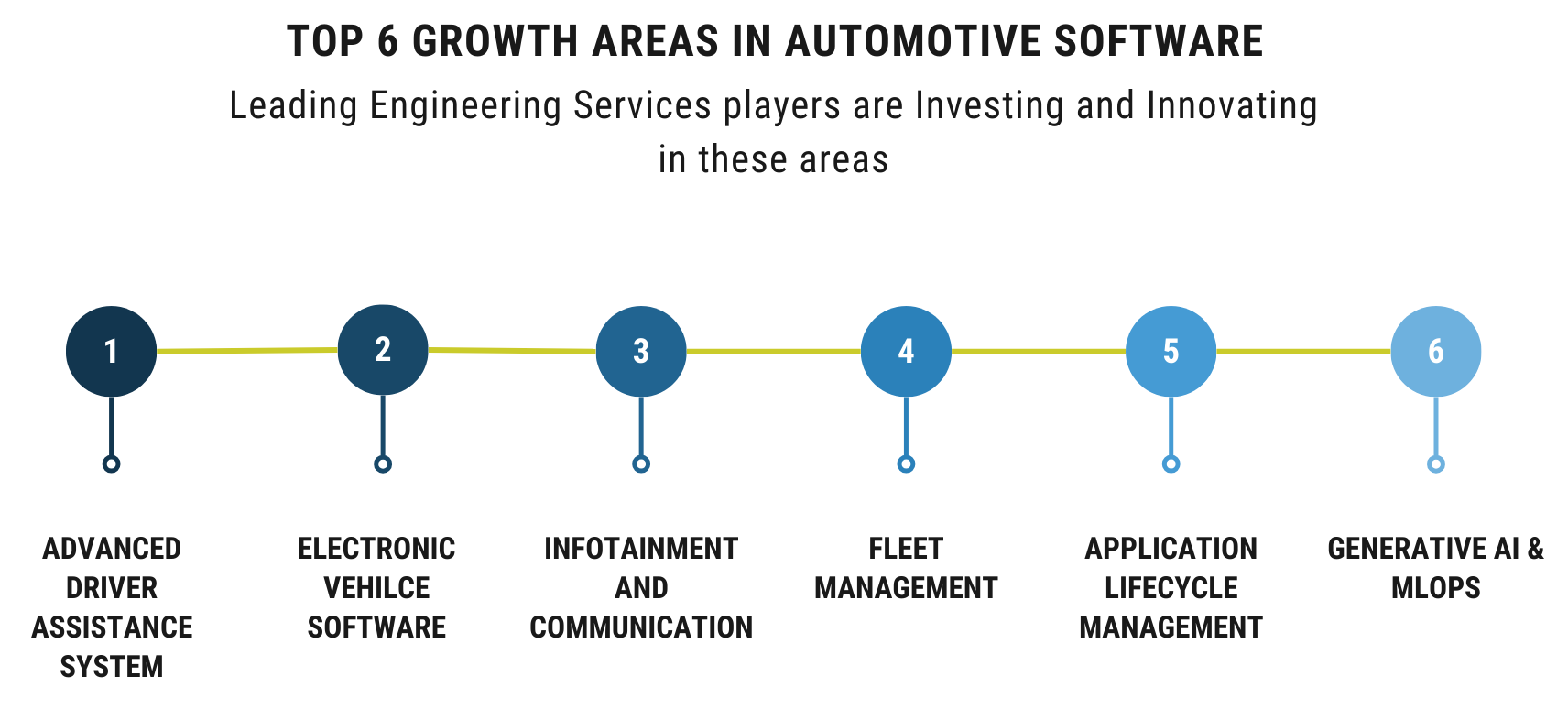

We observed a few exciting areas, where some companies have built specialized capabilities and are leading Innovation across the Automotive Software Engineering Services segment:

- ADAS: Players like Tech Mahindra are advancing image-recognition systems for improved safety and driver assistance.

- EV Software: Tata Elxsi's battery management systems exemplify innovation in maximizing efficiency and lifecycle of EVs.

- Infotainment: GlobalLogic is integrating smart apps into vehicle systems for enhanced navigation and entertainment experiences.

- Fleet Management: HCL Technologies' solutions now allow for real-time monitoring and data analytics for optimal fleet performance.

- Application lifecycle management: Capgemini Service SAS is providing comprehensive support for business applications in financial services and insurance.

- Generative AI for SDV: L&T TS, using Amazon Web Services (AWS), is aiding the transition to SDVs with generative AI.

Mergers & Acquisitions landscape

In the swiftly evolving automotive landscape, agility in scaling capabilities is crucial. In the context of an industry increasingly steered by software, it's critical for suppliers, specialized software firms, and solution providers to forge strategic alliances. Such collaborations are key for distributing the significant investment burden necessary for cultivating software development competencies and evolving into software-centric entities. This trend is evident industry-wide, with premier Tier-1 suppliers either fully integrating or forming partnerships with software enterprises in the sector.

In Sep 2023, HCLTech, a prominent global technology firm, acquired ASAP Group, an automotive engineering services provider based in Ingolstadt, Germany. ASAP, with over 1,600 employees across nine locations in Germany, specializes in future-oriented automotive technologies like autonomous driving, e-mobility, and connectivity. HCLTech, known for its leadership in engineering and R&D services, collaborates with 63 of the top 100 global R&D spenders. This acquisition aims to strengthen HCLTech’s position in the automotive engineering services sector in Europe and globally, enhancing its advanced technology capabilities.

In Sep 2023, SynSpace, a consulting company specializing in optimizing development processes for software-based systems, particularly in the automotive industry, was acquired by IAV Group. Having established its brand in the automotive sector for over 30 years, SynSpace's expertise lies in areas like Automotive SPICE, Automotive Cybersecurity, and Functional Safety. They offer consulting services, training, and audits.

In Mar 2023, Acsia's strategic acquisition of Arctictern Solutions, a German automotive software services start-up, allows it to tap into Germany's rich automotive industry. This move is not just a market expansion but a strategic placement in one of the leading automotive hubs of the world.

In Oct 2022, KPIT Technologies, a global software integration partner for the automotive and mobility industry, had acquired Munich-based Technica Engineering, a specialist in system prototyping, automotive ethernet products, and validation tools, advancing the transformation towards Software-defined Vehicles (SDV). The acquisition strengthened KPIT's operational scale and value, facilitating a rapid transition to SDV by improving prototyping and software access, and reducing workflow complexities for clients.

The concept of software-defined vehicles (SDVs) is revolutionizing the industry, leading to platformization—a trend where vehicles are built on a shared software platform. This shift allows for more efficient development cycles, easier updates, and customization options for consumers, which in turn might reshape M&A strategies. Companies are aligning their acquisitions to secure not just technology, but also the platforms that will drive the future of automotive innovation.

Future Outlook

As we look to the future, the automotive sector is poised to evolve significantly due to rapid technological advancements. The focus will increasingly shift towards forging long-term strategic partnerships, enhancing life cycle monetization strategies, and fostering a culture of continuous innovation. In an era where vehicles are becoming more reliant on sophisticated software, the industry is expected to prioritize agility in development processes, encourage cross-functional team collaborations, and heavily invest in cloud-based service solutions.

Looking ahead, there are several key drivers as outlined in this blog, that are likely to accelerate investments and M&A in the automotive software sector. As the automotive software ecosystem continues to evolve, companies will need to stay competitive by acquiring or partnering with digital engineering or specialized engineering services firms who bring complementary technology expertise and capabilities, while they benefit from the investments, scale and go-to-market of a larger strategic player.

We see a few other growth areas leading to M&A opportunities driven by the increased focus on data and analytics to improve the driving experience. As cars become more connected and autonomous, companies will need to be efficient with designing advanced solutions that collect and analyze vast amounts of data to maintain a competitive edge. With the exception of a few large players who have addressed this gap through various approaches ranging from technology partnerships to complementary acquisitions, the vast majority of mid–sized and large automotive software companies are chalking out various approaches which we foresee could lead to a spurt in Automotive Software M&A activity H1 2024.

As more companies look to expand ADAS, EV, SDV and data-driven software capabilities, we expect this trend to continue for the next few years.

To share feedback on this blog or explore a potential transaction opportunity you may be considering, please write to us at [email protected]

Newsletter Subscription

SubscribeREAD NEXT

- Smart, Connected, and Autonomous: The Role of Digital Engineering in Next-Gen Vehicle

- Opportunities in Generative AI: Fueling Innovation and Strategic Growth

- Digital Engineering: Powering Innovation & Growth Across Mission-Critical Industries

- Weaving the Future: How Data Fabric Powers Enterprise Transformation

- The Modernization Trinity: Unlocking Growth with Cloud, App and Data Modernization

Subscribe

Stay current with our latest insights in your inbox.