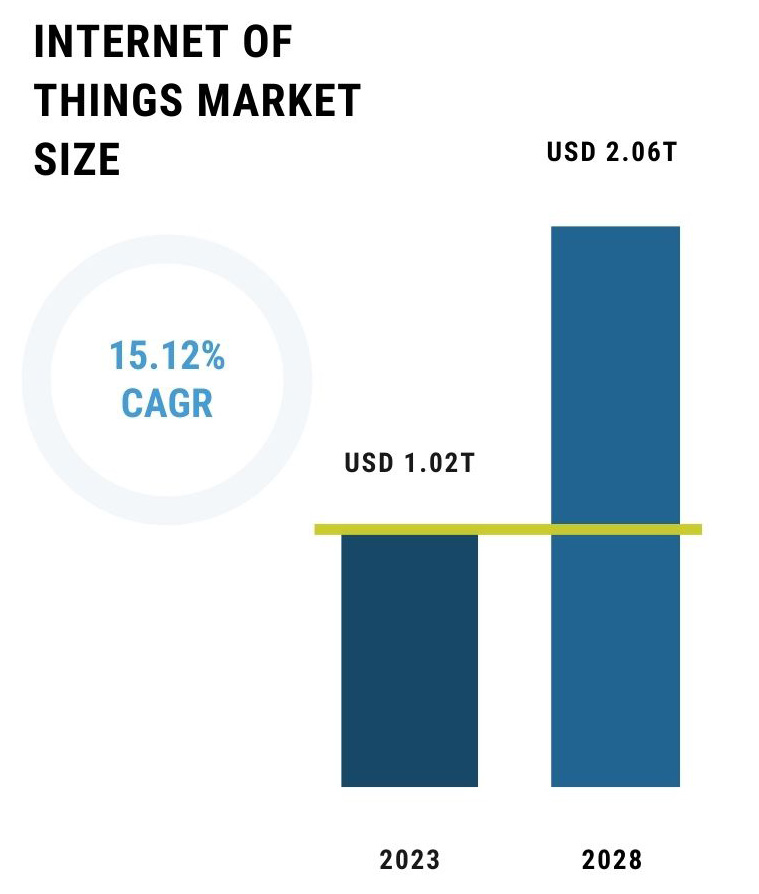

Industry 4.0 and IoT are driving new technological approaches for smart factory automation. Enterprises are increasingly embracing agility and innovation to enhance production, combining human labor with robotics to reduce industrial accidents and improve efficiency. The widespread adoption of connected devices and sensors has led to a surge in data points in manufacturing. These data points range from simple metrics like process cycle times to advanced measurements like material stress capability in the automotive industry. Advancements in field devices, sensors, and robots are expanding the market scope. IoT technologies address labor shortages in manufacturing, with organizations increasingly integrating Industry 4.0 technologies like robotization into their daily operations. The IoT Market size is expected to grow from USD 1,017.31 billion in 2023 to USD 2,056.87 billion by 2028, at a CAGR of 15.12%. In 2023, it is predicted that there will be more than 43 billion devices connected to the internet.

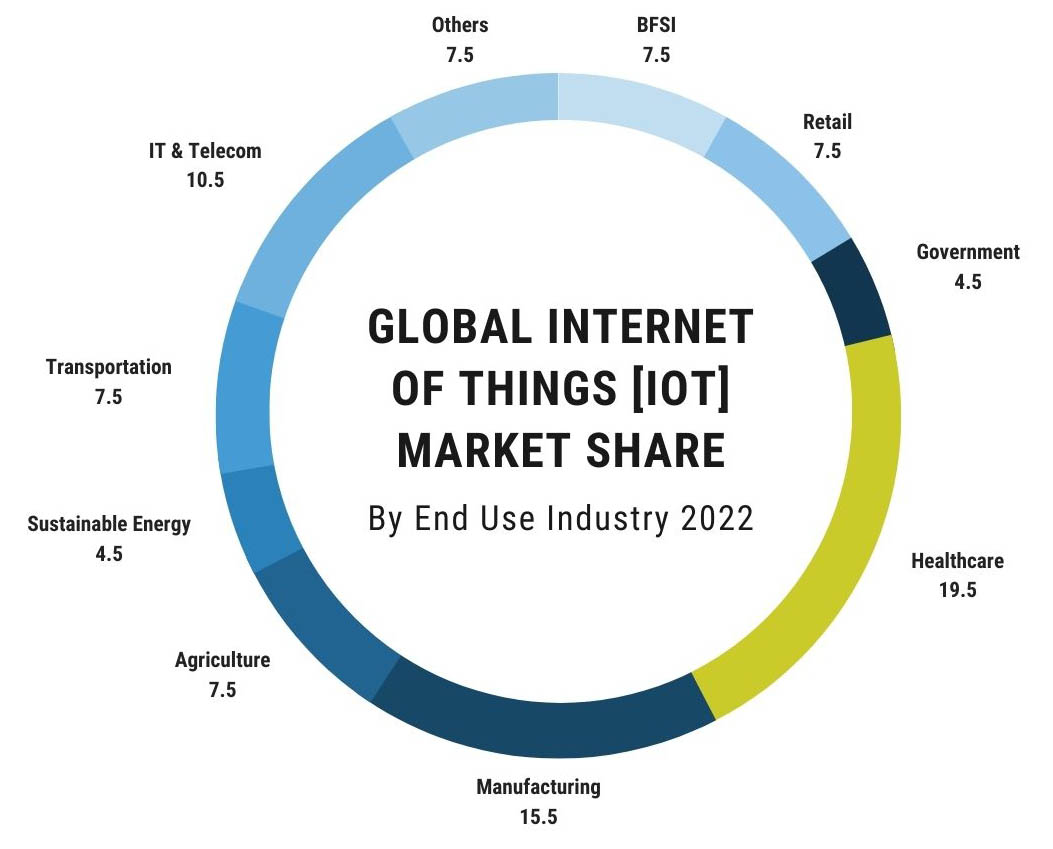

According to McKinsey, the economic impact of IoT in the human health setting is estimated to reach around 14% of the total, between $0.5 trillion and $1.8 trillion, by 2030. In recent years, the perceived value of IoT solutions in healthcare has increased significantly. Connected devices such as glucose and heart monitors for chronic disease patients and mass-market solutions for monitoring physical activity have gained consumer awareness. IoT solutions are not only utilized by individuals but also offered by insurers and governments to enhance health outcomes. The COVID-19 pandemic has potentially accelerated the adoption of IoT solutions in healthcare as the world strives for virus containment and a safe return to work environments.

Autonomous vehicles represent the fastest-growing IoT-value cluster in 2023. While autonomous-driving systems receive significant attention, the use of sensors in vehicles is steadily increasing as consumers demand enhanced safety and reliability. Over the next few years, the addition of safety features is expected to contribute significantly to the value generated by IoT in the automotive industry. The global Automotive IoT Market in terms of revenue was estimated to be USD 131.2 billion in 2023 and is poised to reach USD 322.0 billion by 2028, growing at a CAGR of 19.7%.

IoT enables manufacturers to collect data from various machines and equipment in the factory, allowing them to identify trends and areas for improvement. This allows monitoring of production status in real time. This enables easy replication of the production processes, automated auditing and timely resolution of production-related problems. The global IoT in manufacturing market size was valued at $50.0 billion in 2021 and is poised to generate $87.9 billion by the end of 2026.

Another sector that’s gaining momentum in IoT implementation in retail. Due to the seismic shift in demand for IoT in retail, its market size is expected to hit $177.90 billion by 2031, as per Allied Market Research. RFID & GPS technologies allow retailers to identify and inspect every object across warehouses, in transit and on the shelves, allowing for optimized supply chain management. IoT capabilities and ML algorithms can accurately assess consumer data to personalize shopping experiences. Moreover, aisle analytics software clubbed with infrared sensors enables IoT technology to improve the in-store layout that helps optimize customer behavior.

The latest IoT Analytics report shows that global IoT connections grew by 18% in 2022 to 14.3 billion active IoT endpoints, predicted to grow by 16%, to 16.7 billion endpoints. Microsoft, with a 9% market share in 2022, leads the IoT software market and offers a comprehensive range of solutions including Azure IoT Hub and Azure RTOS, while Amazon Web Services (AWS) is a prominent player in IoT software with investments in AWS IoT Core and expected growth in IoT software spending. Players like Siemens, IBM, Cisco, Oracle, PTC, MongoDB, SAP, Google Cloud, Intel are few of the market's main participants. Product innovation and mergers and acquisitions are two important methods used by these leading market participants.

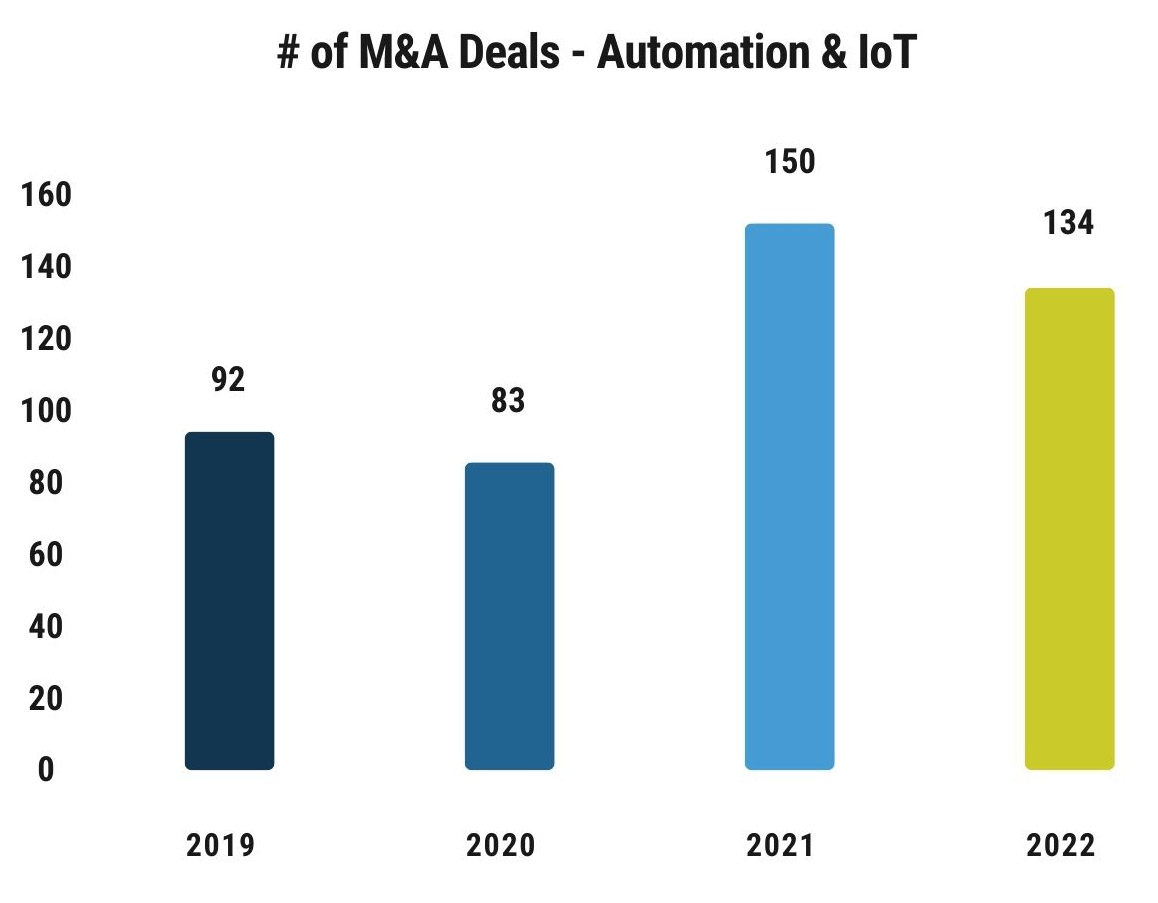

The Internet of Things (IoT) market is highly competitive owing to the presence of many large and small players in the market operating in the domestic and international markets. Due to the high presence of technology, the market seems to be fragmented and there is increasing scope for M&A activity. These drivers include the need for scale, complementarity, market share, and access to new markets. The last 18 months have seen several notable acquisition and divestment announcements in the IoT ecosystem. Google Cloud IoT Core announced its shutdown, Ericsson revealed the sale of its IoT business unit to Aeris Communications, Semtech acquired Sierra Wireless, Kore bought Twilio’s IoT unit, UnaBiz bought Sigfox, and Thales’ IoT unit was sold to Telit. As the IoT market continues to grow, we can expect to see even more M&A activity in the years to come.

Investors, this year, are aiming to capitalize on mid-market opportunities, where they can inject liquidity into cash-rich companies that offer IoT solutions in niche areas such as data science, artificial intelligence, augmented reality and cloud. The following are some of the recent 2023 acquisitions in the IoT space:

In January 2022, HCL Technologies, a global technology company, announced its acquisition of Starschema, a leading data engineering services provider based in Budapest, Hungary. This strategic move was aimed at bolstering HCL's capabilities in digital engineering, especially in the realm of data engineering, and expanding its presence in Central and Eastern Europe. Starschema, with its expertise in offering consulting, technology, and managed services in data engineering to major companies in the U.S. and Europe, presented a valuable addition to HCL's portfolio. By integrating Starschema's high-value capabilities and data-centric expertise, HCL aims to further solidify its position in data engineering, a pivotal component of its digital engineering capabilities and next-generation offerings.

In April 2022, ACL Digital, a subsidiary of the French multinational Alten Group, acquired Volansys, a consultancy specializing in internet of things (IoT) solutions. Founded in 2008, Volansys has been instrumental in assisting clients with the creation of IoT products compatible with major cloud platforms. This strategic move by ACL Digital aims to bolster its offerings in product engineering, digital transformation, and the IoT domain. By integrating Volansys' technological agility and expertise, ACL Digital anticipates enhancing its proficiency in delivering IoT solutions, cloud services, and the design and development of intelligent consumer electronic devices. The acquisition underscores ACL Digital's commitment to evolving as a top-tier digital solutions provider and fortifying its leadership stance in the digital, engineering, and IoT sectors.

In February 2023, Cognizant entered into an agreement to acquire Mobica, an IoT software engineering services provider headquartered in Manchester, United Kingdom. The acquisition significantly expands Cognizant's IoT embedded software engineering capabilities catering to automotive and technology clients, enhancing the acquirer’s growing development teams in Eastern Europe. Mobica's expertise in three key areas – connected devices and digital transformation, silicon and technology platforms, and automotive and intelligent mobility – is expected to further strengthen Cognizant's client offerings and position as a strategic partner in enterprise digital transformation.

The IoT landscape, characterized by its rapid growth and diverse array of participants, is undergoing a dynamic evolution. Mergers and acquisitions (M&A) have emerged as strategic tools for companies to navigate this market, allowing them to achieve scale, access new technologies, and penetrate fresh markets. The fluctuating M&A activity over the years underscores the sector's resilience and adaptability. As the IoT ecosystem continues its expansion, we can anticipate a thoughtful and strategic approach to M&A, shaping the future trajectory of this promising domain.

On the back of buoyant investment opportunities within the sector, some of they key IoT technology trends that are emerging and expected to continue through all of 2023 and 2024 are:

1. IoT Security

In the United States, the White House National Security Council aims to establish standardized security labeling for consumer IoT device manufacturers by early 2023. This labeling system will provide buyers with information about the potential risks associated with specific devices, helping them make informed decisions when introducing them into their homes. Basic cybersecurity attacks, such as phishing, often rely on social engineering techniques and can be mitigated through user education and precautionary measures. The UK is also expected to introduce its own legislation, the Product Security and Telecommunications Infrastructure (PTSI) bill, to address IoT security concerns.

In the IoT industry, particularly in the consumer sector where networks serve as the primary barrier against data breaches, spending on security measures is projected to reach $6 billion in 2023. This increased investment reflects the growing recognition of the importance of robust cybersecurity practices to protect sensitive personal data and mitigate the risks associated with IoT devices.

As per Statista’s report, the IoT security market is expected to reach 38.7 billion in 2023, up from 34.2 billion in 2022.

2. The Internet of Healthcare Things

The global IoT healthcare market is set to reach a staggering $14 billion by 2024. One transformative aspect of IoHT is the use of wearables and in-home sensors, allowing healthcare professionals to monitor patients remotely outside of traditional medical settings. This continuous monitoring enables round-the-clock care while alleviating the strain on healthcare resources and prioritizing immediate attention for patients in need. In 2023, the concept of the "virtual hospital ward" will gain traction, where doctors and nurses oversee patient monitoring and treatment through sensors and telemedicine in the comfort of their own homes. As real-time data monitoring demand increases, the IoT healthcare industry is predicted to grow at a CAGR of 19.9% over five years.

On the consumer side, wearable devices empower individuals to gain insights into their health and fitness, contributing to a proactive approach to healthcare. This, in turn, can ease the burden on healthcare systems by facilitating early intervention and fostering a better understanding of the impact of lifestyle factors like diet and exercise on health. Smartwatches with ECG and SpO2 sensors have become commonplace, and the upcoming year will likely witness the introduction of additional products like wearable skin patches to further enhance health monitoring capabilities.

3. Edge Computing

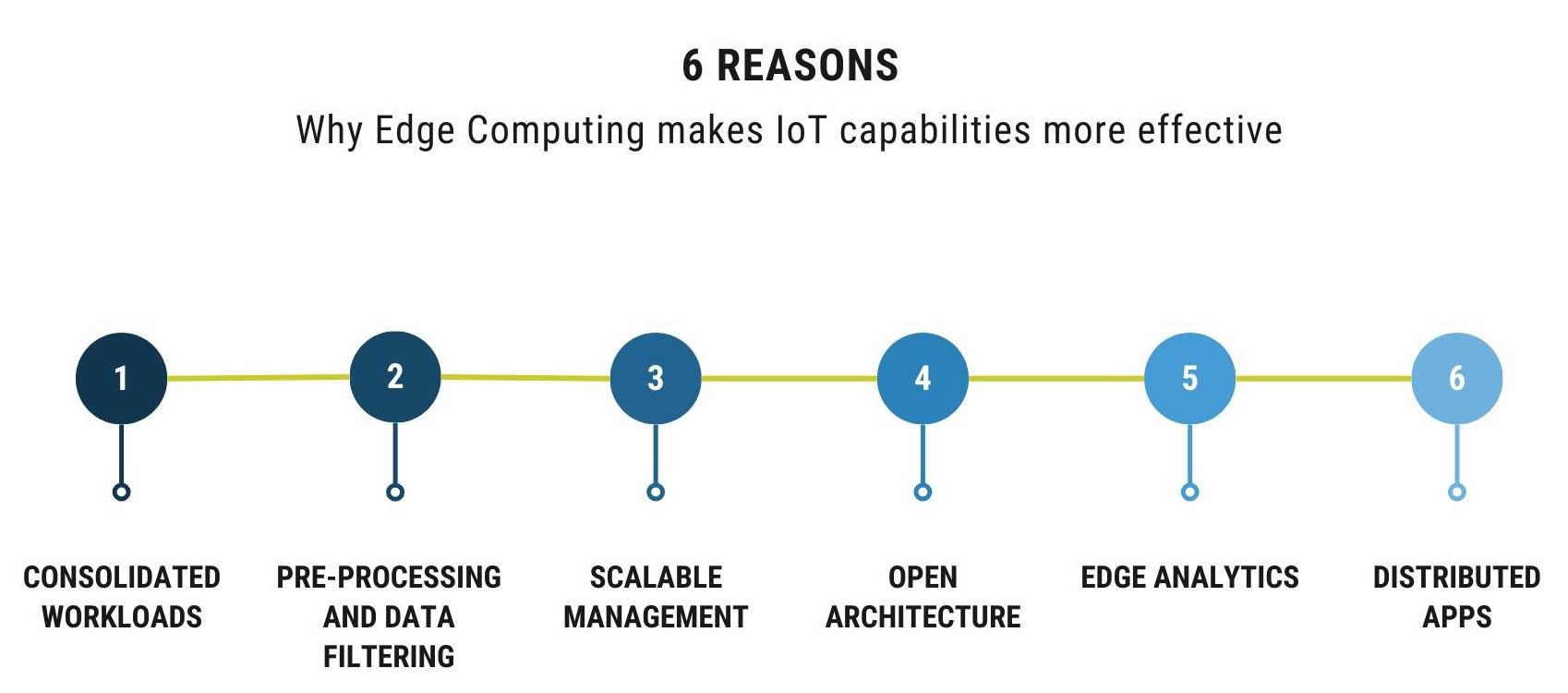

The edge computing market size is expected to grow from USD 53.6 billion in 2023 to USD 111.3 billion by 2028, at a CAGR of 15.7%, according to GII Research. This involves moving computing, storage, and networking functions closer to users or data sources. This proximity allows for faster, more reliable services, enhanced user experiences, and the deployment of latency-sensitive applications. Combining edge computing with the IoT enables organizations to deploy workloads on IoT hardware, improving performance and enabling new use cases such as low latency and high throughput data. This convergence facilitates more flexible and advanced IoT applications compared to traditional approaches.

In many IoT scenarios, devices generate and send small data packets to a central management platform for analysis. While this approach works for some applications, the anticipated growth of IoT will lead to an overwhelming number of devices and network congestion. Edge computing addresses this challenge by optimizing bandwidth usage and only sending essential long-term storage data to the central platform, rather than transmitting all data. Furthermore, Edge Computing enhances IoT capabilities with hypervising multiple operations, centralized management and associated analytics to optimize as needed. Let's look into details of why Edge computing is an important enhancer for IoT functionalities.

- Consolidated Workloads: Modern IoT devices can run multiple operating systems using hypervisors, allowing for flexible consolidation of workloads on a single device, reducing physical footprint and improving resource utilization.

- Pre-Processing and Data Filtering: IoT edge computing involves pre-processing data at the edge, sending only relevant information to the cloud. This reduces network bandwidth, enhances performance, and minimizes cloud storage needs.

- Scalable Management: IoT edge devices can be connected to LAN or WAN, enabling centralized management and integration into the network ecosystem. Edge management platforms facilitate fleet management.

- Open Architecture: Modern edge computing adopts open architectures with standard protocols and data structures, promoting interoperability, easy integration, and agility of edge systems.

- Edge Analytics: IoT edge systems have powerful processing capabilities, enabling data analysis at the edge for low latency and high data throughput, unlocking new use cases.

- Distributed Apps: Modern IoT edge computing allows decoupling of applications from hardware, enabling vertical and horizontal scalability by moving and scaling applications between edge resources and the cloud.

4. IoDT- Digital Twins

According to Digital Journal, the global digital twin market in IoT is expected to reach $35.8 billion by 2025, growing at a CAGR of 45.9% from 2020 to 2025. Digital twins are virtual replicas of physical objects or systems that can be used to simulate and optimize their performance. By leveraging data from IoT sensors, organizations can create highly realistic digital twins that can be used to bridge the gap between the physical and virtual worlds. This allows business users to immerse themselves in the virtual environment through experiential technologies like VR headsets, providing a deeper understanding of the inner workings of these systems and allowing them to explore the potential impact of adjusting different variables on business outcomes.

The Internet of Digital Twins (IoDT) is a network of connected digital twins that can be used to share information and insights across various physical entities. This can be used to improve planning and decision-making, and to enable dynamic synchronization and cooperation between physical entities and their virtual counterparts. One notable application of the IoDT is the ability to create digital twin cities. According to Gartner, 13% of firms undertaking IoT initiatives are already using digital twins and 62% of firms plan to do so. This has already been done in Shanghai, where a digital twin of the city was created to aid in planning and responding to the COVID-19 pandemic. This type of application has the potential to revolutionize urban planning and management, as it allows for more efficient and effective decision-making.

The IoT market is expected to continue to grow in the coming years, driven by the increasing adoption of IoT solutions in tech, healthcare, retail, manufacturing, and transport-related verticals. Investors are looking to capitalize on this growth by investing in mid-market opportunities. A major headwind to this trend is the lack of skilled workers in the IoT industry, with 3.5 million IoT-related jobs expected to go unfilled by 2025, according to Gartner. To address this, we encourage investors and targets to promote automation since this can help streamline the integration process and reduce the risk of errors, and facilitate collaboration through clear established processes. These measures would help CISOs and I&O leaders manage complex technologies and data during acquisitions, allowing innovation and M&A activity in the IoT market.

Conclusion

We expect the IoT investment landscape to remain vibrant in 2023, and beyond, driven by an acceleration of growth opportunities and a need for capital to fuel innovation and competitiveness. . The convergence of Industry 4.0 and IoT is driving smart factory automation, revolutionizing manufacturing processes, and enhancing efficiency and safety through the integration of connected devices and robotics. It is evident that relative to prior quarters, there is keen interest from both strategic and financial investors to deploy capital into mid-market entrepreneurial companies focused on unlocking the potential of IoT technologies and their applications across industries to gain a competitive edge and build profitable high-growth revenue streams.

Newsletter Subscription

SubscribeREAD NEXT

- Smart, Connected, and Autonomous: The Role of Digital Engineering in Next-Gen Vehicle

- Opportunities in Generative AI: Fueling Innovation and Strategic Growth

- Digital Engineering: Powering Innovation & Growth Across Mission-Critical Industries

- Weaving the Future: How Data Fabric Powers Enterprise Transformation

- The Modernization Trinity: Unlocking Growth with Cloud, App and Data Modernization

Subscribe

Stay current with our latest insights in your inbox.