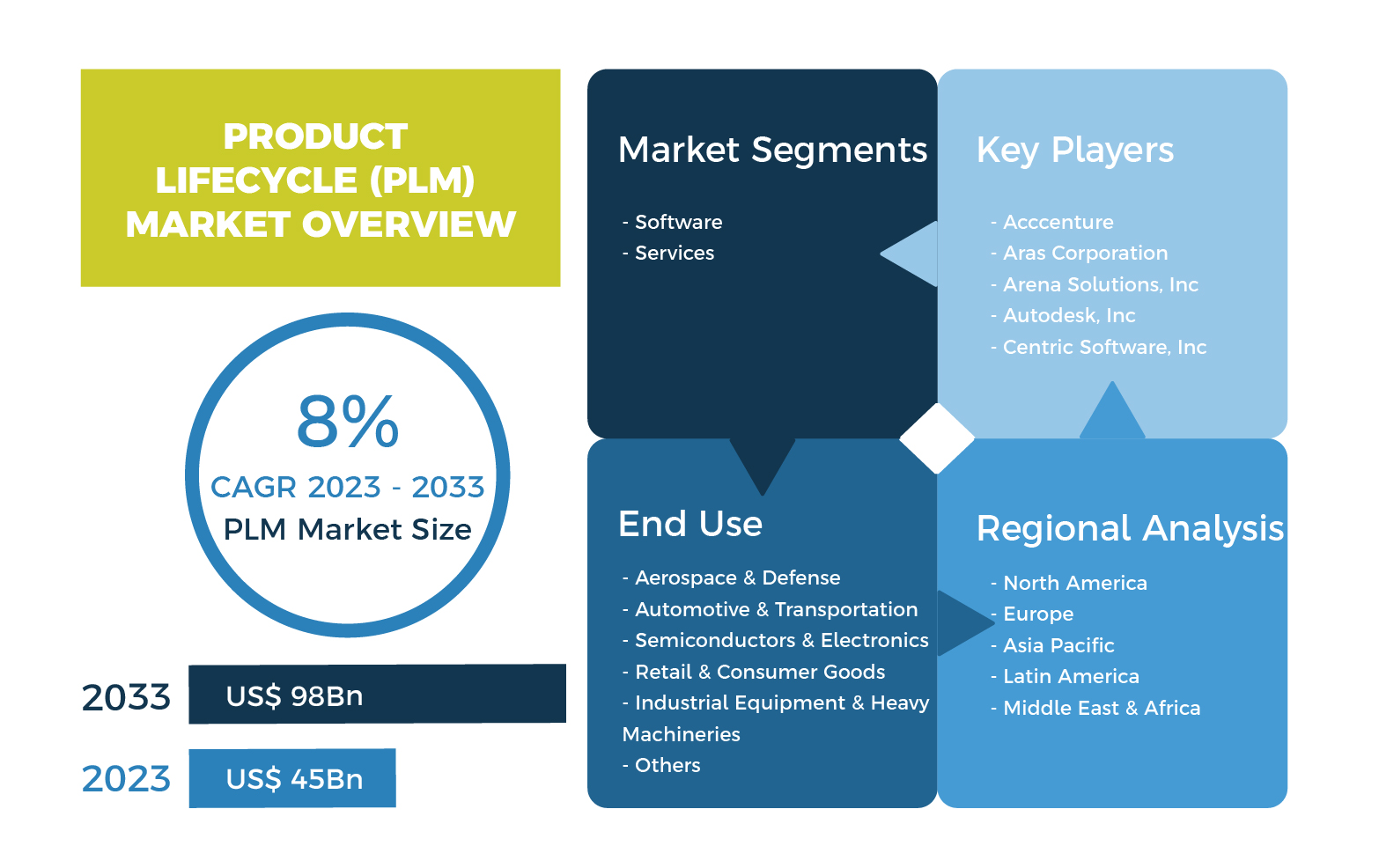

Companies are accelerating their product innovation strategy to adapt to shifting market demands and ever shorter product cycles. Hence, real-time product lifecycle management involves systematic information management. This makes Product Lifecycle Management(PLM) solutions essential for fostering corporate innovation. These needs are predicted to boost PLM market growth from 45 bn USD in 2023 to 98bn USD in 2033 at 8% CAGR, as stated by Fact MR. Aras, Arena Solutions, Oracle, SAP, Autodesk, Siemens, PTC, ANSYS, Dassault Systèmes, and Synopsys. are the market's major players. Market-leading companies are proactively spending in R&D, upgrading internal processes, developing new features, and improving their present products to drive organic growth, gain new consumers, and raise market shares. Recently, PTC. and KPMG piloted a 5G private cellular network to give clients and professionals a controlled environment to interact, experiment, and explore immersive, new business models of the future with AR/VR technologies. It will also demonstrate how next-generation networks can help businesses digitally transform by using advanced technologies to elevate user experience at every interaction level and process across an enterprise.

PLM software market trends

Current global product life cycle management industry trends define product timelines and roadmaps. Predictive analytics, improved visualization, additive manufacturing, and model-based engineering drive the technical adoption of PLM software that can analyze and display insights on a product evolution cycle. Scalability, flexibility, security, and data control will likely accelerate the adoption of cloud-based product life cycle management software. Thus, cloud deployment of PLM is projected to remain an important growth area.. This can be witnessed from the growing importance of true digital twins with realistic simulations of physical manufacturing plants and products, which in combination is speeding up PLM adoption This is also supported by the ability to now leverage multiple software tools like CAD, CAM, CAE tools in the age of Industry 4.0, integrating data from multiple enterprise systems, being flexible through true low-code development platforms to meet dynamic challenges quickly. Increasing adoption of PLM software tools and solutions has now become critical for embracing greater variation in engineering requirements and larger supply chain complexity with embedded software and electronics, leveraging AI to extract more advanced predictive and descriptive analytics.

Technology adopters

According to Gartner, the automotive industry is the largest user of PLM software, followed by the aerospace and defense, and high-tech industries. Over 20% of predicted sales came from automotive & transportation. Digital manufacturing and IoT integration in smart cars will drive the automotive business. Global PLM in the discrete manufacturing market grew from $21.11 billion in 2022 to $22.89 billion in 2023 at a CAGR of 8.4%. Siemens PLM Software provides innovative car solutions for all technical disciplines, from chip design to vehicle validation. These characteristics should encourage automotive and transportation incumbents to use product lifecycle management software. Industrial digitization, integrated value chains, and business strategies have been evolving, thus; most businesses are adopting lean and collaborative product development methods defining work processes and automation.

Aerospace & defense is expected to grow 5.9% over the next 4 years, according to Research and Markets. Budget cuts, global competitiveness, and commercial aircraft delivery and production backlogs drive defense and aerospace product lifecycle management systems. Military aerospace & defense firms increasingly seek technologically advanced lifecycle management solutions to optimize critical operations. Simulation, testing, and change management will grow by 9.7% throughout the predicted period. Simulation & testing management solutions are in demand due to the requirement to control and standardize processes, reduce implementation costs, and boost traceability and industrial automation.

Additionally, the health industry would incorporate PLM through the adoption of digital twins, and build models of physical products in a virtual space. Doctors and physicians analyze tailored data provided by digital twins to comprehend how patients or machines manage various circumstances. Digital twin technology forecasts, locates patterns and compares one specific data set to a population to examine trends. The digital twin and thread trends are unique and easy to implement, making them an essential asset in the PLM world. Allied Market Research also sees this technology as a resource, which is likely why they predict the global digital twin market will reach $125.7 billion in 2030.

Institutional Investors, this year, are aiming to capitalize on mid-market opportunities and strategic partnerships with entrepreneurial companies, where they can inject liquidity, leverage synergies, drive expansion of technologically advanced products and grow market share. The following are some of the recent 2023 acquisitions in the PLM space:

In July 2023, Deloitte acquired data and PLM firm D-Twin as part of its expansion of offerings and market presence in the area. On their own, Deloitte and D-Twin have been delivering high value PLM client solutions for a number of years across complex product and asset heavy sectors. The inclusion of the D-Twin team into Deloitte’s Smart Industries offering, enhances their ability to create genuine sovereignty in Australia through the continuous digital thread spanning design, manufacturing and through-life value.

In Jan 2023, Boston based PTC acquired ServiceMax from an entity majority owned by Silver Lake. The acquisition adds important field service management (FSM) capabilities to PTC’s closed-loop product lifecycle management (PLM) and digital thread offerings. ServiceMax provides a comprehensive suite of cloud-native FSM capabilities for servicing complex long-lifecycle products, including managing information about serviced products, creating and managing work orders, and scheduling and dispatching technicians.

In September 2022, Siemens Partner OnePLM was acquired by an European Digital Transformation consortium, supported by Holland Capital. OnePLM's expertise in delivering PLM solutions, combined with the technologies provided by Siemens, SAP, Mendix, and Boomi, enhances the consortium's ability to drive the digital transformation of manufacturing processes. By joining forces, the consortium aims to provide comprehensive services in product lifecycle and asset management, IT architecture, low-code applications, system integrations, and process optimization. This is part of the consortium's growth strategy, supported by Holland Capital, to pursue a buy-and-build approach, expanding their capabilities and customer base.

AVEVA Solutions Limited and Aras formed a strategic OEM relationship to provide industrial "Asset Lifecycle Management" solutions in September 2022. AVEVA would license the Aras Innovator platform to deliver scalable Asset Lifecycle Management solutions that integrate Aras' flexible and open array of applications with AVEVA Asset Information Management and Unified Engineering. Aras’ low-code platform would be complementary to AVEVA’s agile approach to industry solutions, allowing for data-driven operations for lifecycle management.

As emerging and mid-sized product companies are investing in PLM solutions across industrial verticals to optimize manufacturing costs and power innovation,, there are essentially four key PLM trends that investors are expected to consider in 2023 and 2024:

1. Industrial Internet of Things (IIoT) sector

Virtual reality, augmented reality technology, and additive manufacturing are expected to enhance product lifecycle management market spending over the forecast period. These technologies will drive organizations to add additional features to their PLM solutions, increasing demand. IoT integration with PLM solutions is a significant advancement. This integration has enhanced product lifecycle management solutions, enabling post-manufacturing performance and quality management. The top three IIoT PLM vendors currently are Siemens, Dassault Systèmes, and PTC. Smart devices and systems with IoT sensors generate valuable, actionable data, such as product part failure warnings. PTC Inc. and Siemens are integrating these technologies to boost their market share. Siemens unveiled AssistAR 3.0, a new generation of accurate and robust augmented reality (AR) technologies for assembly, inspection, and maintenance. It combines PCs and displays to guide firm personnel through complex procedures without glasses or a headset. Autodesk Fusion 360 offers the most substantial enhancement to any workflow and continually improves to satisfy the needs of engineers, professional designers, and machinists. Fusion 360's new mesh environment gives a historical timeline for mesh adjustments and enhanced conversion options, allowing users to undo/redo activities.

2. Cloud PLM

Gartner predicts that by this year, 65% of product lifecycle management (PLM) deployments will be in the cloud. The cloud-based PLM market is being driven by the increasing adoption of cloud computing, the growing demand for collaboration and mobility, and the rising need for compliance in manufacturing. The automotive industry is the leading adopter of cloud-based PLM. This is followed by the aerospace and defense industry, and the industrial machinery and equipment industry. It provides enhanced accessibility, robust security measures such as two-step authentication and data encryption, reliable data storage and backups, and efficient access control. By leveraging cloud solutions, organizations can streamline their PLM processes, enhance collaboration, and protect valuable product data throughout the entire product lifecycle. The Asia-Pacific region is the fastest-growing market for cloud-based PLM. This is followed by North America and Europe.

Here are some specific examples of how cloud-based PLM is being used in manufacturing today:

- Collaboration: Cloud-based PLM platforms allow users to collaborate on product data in real time, regardless of their location. This can help to improve the efficiency of product development and reduce the risk of errors.

- Mobility: Cloud-based PLM platforms can be accessed from any device with an internet connection. This allows users to access product data and collaborate on projects from anywhere in the world.

- Compliance: Cloud-based PLM platforms can help manufacturers to comply with regulations such as ISO 9001 and FDA 21 CFR Part 11. This can help to protect their brand and avoid costly fines.

3. AI and PLM

By 2024, over 50% of user interactions will be through AI-enabled computer vision, speech, NLP, and virtual and augmented reality. Recent advancements in AI, combined with the availability of cloud computing, have made AI more accessible and have the potential to reshape PLM development. Data availability is crucial for successful AI implementation in PLM. Design files, Bill of Materials (BOM), maintenance reports, and enterprise databases serve as critical data sources. Integrating different AI technologies, such as natural language processing, computer vision, knowledge graphs, and rule-based systems, can enhance decision-making and optimize various aspects of PLM. Contextualizing AI for specific organizations involves breaking down data silos and enabling cross-functional data reuse. By analyzing data from multiple departments, AI algorithms can provide a comprehensive understanding of the product lifecycle and optimize processes.

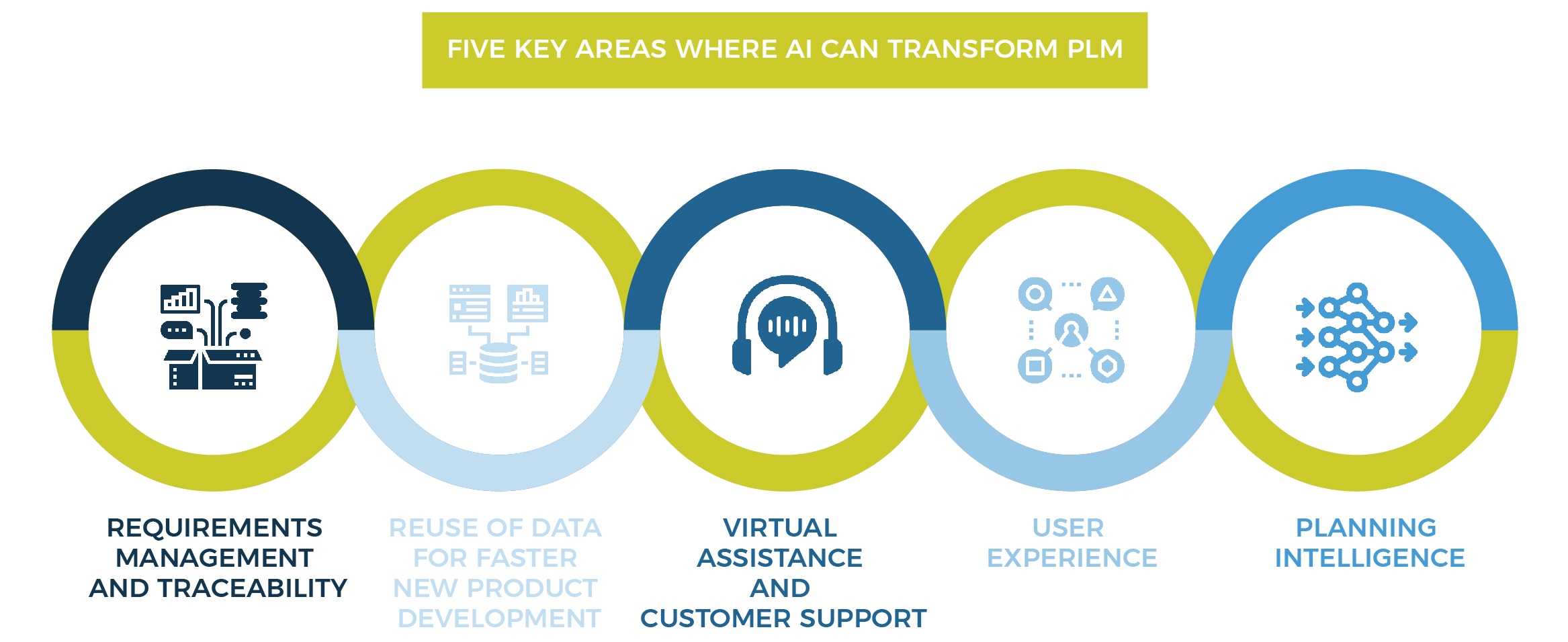

There are five key areas where AI can transform PLM:

- Requirements Management and Traceability: NLP can enhance requirement management tools by analyzing and summarizing large sets of information and documents.

- Reuse of Data for Faster New Product Development: AI-driven data management systems can analyze diverse data sources to identify patterns and relationships, suggesting opportunities for data reuse and streamlining the product development process.

- Virtual Assistance and Customer Support: AI tools can assist in tasks requiring human interaction, such as planning meetings, organizing tasks, and providing interactive manuals and automated customer support.

- User Experience: Bringing AI into the UI/UX component of PLM can potentially enable conversational interfaces and speech recognition

- Planning Intelligence: AI can optimize product design, supplier selection, and complex configurations by analyzing large amounts of data and providing insights to improve decision-making.

4. CAD Integration in PLM

Integrating ECAD with PLM enhances part lifecycle visibility, enabling quicker responses to component changes. Supplier management becomes more flexible, allowing for easier transitions between suppliers. Collaboration between design domains improves through seamless data exchange, facilitating multiple analyses during the design cycle. This helps companies bring products to market on time with reduced risks of delays. Additionally, efficient product compliance reporting is achieved as information is centralized, reducing the chance of outdated documentation leading to costly recalls or withdrawals. By exchanging data seamlessly, interference and heat exchange analysis can be performed multiple times during the design cycle, allowing for early detection and resolution of issues. In contrast, traditional approaches using neutral file formats like DXF, IDF, or STEP result in time-consuming iteration rounds that are infrequent. With a solid and version-managed data exchange process, different domains can synchronize more efficiently, helping companies bring products to market on time with reduced risks of delayed product launches.

Conclusion

As software products develop, software implementation in a company's product line-up becomes more straightforward and effective. Challenges caused by supply chain gaps and delays in many manufacturing businesses led to accelerating Industry 4.0 adoption and digital transformation. Thus several industries needed PLM software to enhance growth rates. To support their business leadership and global expansion, organizations have started acquiring solutions that enable them to improve collaborations, encouraging other suppliers and competitors to invest in PLM software partners and changing the global market for widespread PLM implementation. The result is PLM partners throughout the product supply chain are now helping organizations worldwide adapt to Industry 4.0.

Newsletter Subscription

SubscribeREAD NEXT

- Smart, Connected, and Autonomous: The Role of Digital Engineering in Next-Gen Vehicle

- Opportunities in Generative AI: Fueling Innovation and Strategic Growth

- Digital Engineering: Powering Innovation & Growth Across Mission-Critical Industries

- Weaving the Future: How Data Fabric Powers Enterprise Transformation

- The Modernization Trinity: Unlocking Growth with Cloud, App and Data Modernization

Subscribe

Stay current with our latest insights in your inbox.